Today I have a question that is pivotal for many financial calculations: is it accurate to say the stock market returns 10%?

Today I have a question that is pivotal for many financial calculations: is it accurate to say the stock market returns 10%?

For example, in my 401k debt pay-off calculator I plug 8% as the historical market return. I do this as a conservative measure, as I assume people may point to 10% as an unrealistic return.

But why?

I’m the kind of person who likes to look at the facts. So let’s talk about the historical rate of return for the stock market, as well as dissect a common counter-argument to using it in financial models.

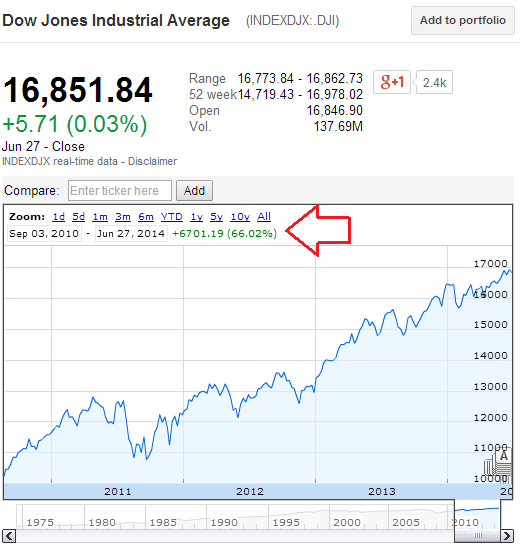

Piggy-backing on an article in USA Today, the rate of return for the stock market is the following:

- 5 years: 1.3%

- 10 years: 2.0%

- 20 years: 7.9%

- 30 years: 10.5%

- 40 years: 9.8%

- 50 years: 9.2%

If you look at returns since 1928 you will see that on average, large-cap U.S. stocks have generated a compound average rate of growth of 9.3% since 1928.

So perhaps the historical 10% return isn’t the best rate to use, primarily because of how poorly the stock market has performed in recent years. 9.3%, or even 9%, is probably the best rate to use. If you really want to be conservative about returns, 8% seems very reasonable.

There are a few arguments that debt pay-off supporters cite in support of paying down debt instead of investing. I’ll address a couple of them, but to be clear I strongly believe that if you agree that the stock market returns at least 8% on average, it is better to invest money than pay down debt that has a lower-than 8% interest rate.

In a previous post I wrote about how I do not advocate paying down more than the minimum payment on student loans, an argument was made that you have to look at investment horizon. If your debt is 3-10 years in length, you have a shorter investment horizon and therefore you can’t rely on the long-term historical average.

This argument is lacking for a couple of reasons. Yes, the global economy went through a recession recently, and returns were dismal to say the least. Some may point to that and say “see, it would have been better to not invest during that time!” While that may be true, let’s get a few facts straight:

- Very few saw the recession coming – There was a very small minority of investment professionals who warned that a housing crisis and recession were imminent. In fact, some literally got laughed at when they stated this view on national television.

If you can predict the short-term rise and fall of the stock market, you probably wouldn’t be reading this and instead would be getting paid millions a year to manage a hedge fund – or retired.

- Hindsight is 20/20 – How many people missed the recovery over the past couple years because they thought they could predict the market’s returns?

This brings us full circle to the question of what rate would be superior to long-term returns? I don’t think there’s a good alternative, at least not one that is solid enough to justify being used in financial models.

Ultimately I don’t have a problem with people advocating paying off debt instead of investing, as long as they recognize that it’s primarily a psychological reason versus one that makes sense from a numbers standpoint.

What rate of return do you advocate using for the stock market? Do you agree with using the historical rate?

____________________________________

Photo by Andreas Poike

Ugh! This is tough, because in all honest, no one can predict exactly what the stock market is going to do. It’s especially tough when you consider the calculations I need to do to make sure that we are able to retire by my goal of 40. I agree that over 50+ years 8% is probably a good, safe estimate, but for a realistic one? Who knows…

I try not to think about it too much because we are so far away from needing any money we have invested or retiring. I just keep investing regularly and making the best decisions I can for us.

I like to stick with the lower calculations, just for safety’s sake. Then I won’t be disappointed when it’s higher. :-)

I always say 8% for 2 reasons. One, because I knew 10 wasn’t entirely accurate. Two, because I would rather be conservative with my estimates. As far as not paying off debt with less than 8%, I think it depends on the tax situation of your investments. If it’s in a tax sheltered retirement account, then that makes sense, but some people have regular taxable accounts…I really don’t, but for whatever reason, some do.

Nice post!

I generally go with 8% since I looking at the long term. Great point about paying off debt versus investing…it is primarily a psychological reason. I have long interest student loan debt…they range from 1.6% to 3.5%. I’m not in a rush to pay them off…especially not the 1.6% ones. I know some who pay off debt no matter how low the rate is because they just don’t like debt. For me, it makes more sense to invest when your rate is so low.

RetiredBy40 That’s exactly the point I’m trying to make. While it might NOT be 8% over the next year, five years, ten years, fifty years, etc., no one is offering a strong argument against using this rate in calculations.

Holly at ClubThrifty That’s fair, Holly, but in a future post I build on this logic to show how this has (or should have) a big impact on our daily/weekly/monthly financial decisions.

Laurie TheFrugalFarmer I think 8% is a good rate to use. It’s conservative enough where it will be reliable even if we hit some rough patches over the next couple decades.

MoneyMiniBlog Yeah I like the conservatism (within reason) so I do use 8% for my calculations, though you really can’t fault someone who uses 9%. I’d be interested in reading a post about some of the tax implications you mention.

Andrew LivingRichCheaply I would kill to get all my student loans down to that interest rate! But yeah, it really is all psychology. I don’t know anyone who has a (valid) theory about why the rate of return will be lower than the historical. Most just hate ANY sort of debt.

I always like to go conservative when I am estimating investment returns for financial planning and I use 7-8% for the stock market. When I was in business school 15 years ago, I remember my professor always used 10% and now I just think that number is a joke. Especially now that the internet is prevalent and information is widely available, it’s hard to expect too big returns from the stock market going forward as they did in the past (i.e. 80s/90s).

I actually use 6%, because I prefer to be conservative.

Good post DC! I’m like Shannon in that my profs would always use 10% as the guide while getting my degree. For a variety of reasons in today’s climate I would lean heavily towards a 7-8% range as opposed to 10%. In regards to our personal investments I always go with the 7-8% assumption as it’s more conservative. If it hits 10% then we’re happy because it’s over what we were expecting the market to return and if 7-8% we’re happy because it’s what we were expecting.

debt debs That’s more than 33% lower than the historical run rate, but to each their own! I think a 10-20% drop is very conservative by most standards.

blonde_finance Interesting to connect the internet and availability of information to returns. I think there could be some strong arguments that there is no correlation between the two, especially with 99% of the experts not seeing the housing crash and recession despite the fact that the internet – and information – were widely available. I would also argue that even with wide availability of information we still have seen markets rise at fast rates.

FrugalRules There’s nothing wrong with being pessimistic or conservative as long as it lines up with the facts. I think 8% is a great figure to use because, historically speaking it’s very conservative.

I use 8 percent for my returns. Is that 9 percent figure based in price of the large cap fund or with dividends reinvested. Dividends are often left out when you run returns based strictly on the price of the index. When you add it back in its often above 10 percent

Great

article YAM – articles like these are good to read because it shows a different

perspective. However, assuming the stock market averages 8%

conservatively is a bit misleading because one could easily overlook other

factors at play.

It is

similar to saying: “Consumers are excited that an F-150 can get 700+ miles

on one fill up!” (benefit) – but you fail to mention that you have to fill

up a 36 gallon tank at today’s prices (cost).

Let me

be more specific:

We are

overlooking the admin fees, trading fees, taxes (oh the taxes), etc., that are

involved when we are ready to use the money for retirement.

We know

now that to invest in index funds and/or ETFs are the best way to go because it

helps to eliminate the fees allocated to those advisors who typically

under-perform the market (90%). In addition, taxes are relatively high

and on their way up, and will begin to siphon even more value from our

portfolios when we need to withdraw from them.

Paying

down debt is a good thing as it raises credit scores and makes more cash

available for investing/saving. But when it comes to investing vs paying

down debt…paying down debt will almost always win. Cash flow is how the

rich get wealthy, the middle class become the upper middle class, the poor

become middle class. Cash flow is king – so when you’re paying down those

debts, you’re creating cash flow.

Cash

flow trumps market volatility because it creates opportunities. When we

had the stock market crash of 2008, many people didn’t have cash flow, so they

couldn’t invest in the stock market and pick up the bargains like I did (Ford

stock = $1.50/share; BAC = $3.00/share; etc) because they were too busy paying

down credit cards or student loans, etc.

Just a

thought – finance/saving/investing is all relative and different for every

person. But in my opinion (and as a retired financial representative),

I’ve seen and helped more people become financially responsible by helping them

build cash flow vs telling them to invest money.

BE FREE

I should say that I’m retired from the financial services industry…not retired as of yet LOL!

I’d like to be conservative and use 8%. I’d consider it a bonus money if my return is higher than that haha. Also, I personally would prefer to pay off my debts as soon as possible. If like there’s a weight on my shoulders if I have any debt and would prefer to live without it as soon as possible! :)