With so many personal finance tools out there it can be overwhelming to decide which to use.

With so many personal finance tools out there it can be overwhelming to decide which to use.

I’ve been asked by others which tools I use. While I test out many tools and apps, there are some that I use more consistently than others.

I should say that some tools that are really useful but you do not need to use regularly. For example, when I signed up for life insurance through Policy Genius it was a one-time use. I don’t need to keep going back and signing up or renewing my life insurance year-after-year (that sounds like it would be terrible).

So this list isn’t an exhaustive list of every personal finance app and tool I use or recommend, but instead a collection of some of the personal finance tools that I use every month.

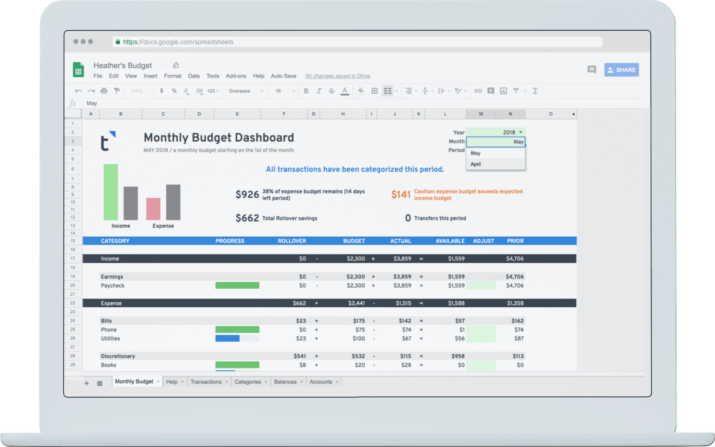

Tiller

Tiller is a relatively simple tool and concept. It aggregates all your income and expense activity from your various accounts and puts it in a uniform format. It’s based in Google Sheets but can be used in conjunction with Excel spreadsheets if you prefer (I do). They have a variety of budgeting templates in Google Sheets that make it easy to use.

I use Tiller to track our income and expenses. I use it in conjunction with an automated budget spreadsheet that I made available on the website for free.

Prior to Tiller coming on the market I used to manually grab data from my credit cards and bank account and put it in a uniform format in Excel. It was an annoying process and I was excited when someone finally started a company that takes this manual step out of the process. I’ve used it ever since.

If you’re interested in trying out Tiller for free for 30 days, please click here.

Personal Capital

Personal Capital is a free software that helps you better manage your money. It goes beyond simply tracking income and expenses and helps with a variety of other areas of your finances. It helps you track your bank account, credit cards, investments, retirement accounts, cash flow, spending and more. (Did I mention it’s free?)

Personal Capital has grown in popularity recently and as of 2019 has over 1.9 million users, myself included. Once you sign up for a free account with personal capital you can link your various financial accounts. Then, in a dashboard you can see the status of all your accounts in real-time. The dashboard view is valuable because it summarizes all your financials in one place, making it easy and efficient to use.

If you’d like to sign up for Personal Capital for free, please click here.

Fidelity

I started to use Fidelity for a simple reason: it’s what my company uses for their 401k and employee stock purchase program.

Besides contributing to my retirement account and acquiring company stock through my employer’s sock purchase program, I don’t actively trade stocks. I’ve purchased some shares of Vanguard ETFs, but I’m not actively buying and selling individual company stocks. With that being said, I mainly go into Fidelity to check how my investments are performing. In reality I could just do this from logging into Personal Capital.

Because my wife and I stick to contributing to our 401k and 403b accounts, we don’t invest in an IRA. If we were to invest in an IRA I would most likely use Fidelity simply because it’s where my other investments are. This isn’t a great reason to choose one IRA provider over another, but at the end of the day I think the investments you choose within your IRA is more important than who services the IRA.

My Bank’s Website

I access my bank’s website at least weekly. Similar to Fidelity, this has more to do with habits than necessity. I could easily access my bank transactions through my Tiller account.

Writing this post reminded me about something on my to do list: move most/all of our emergency fund to a high-yield savings account. CIT Bank is what I’ve had my eye on, as they are currently offering greater than 2% interest on savings accounts when you deposit at least $100 a month or maintain a $25k balance.

If you don’t have an emergency fund please consider putting it at the top of your “money to do list” this year. Here’s a post that can help you get started.

Reward Credit Cards

I always feel the need to caveat talking about credit cards by saying I get it. Credit card debt is a big problem in the United States. Many people who have struggled with credit card debt are better off sticking to a bank account instead of using credit cards.

But if you use credit cards responsibly (meaning, not spending money you otherwise wouldn’t spend and not carrying a balance), it makes sense to shift your spending to credit cards instead of using a debit card or cash. Why? Because of credit card rewards.

Many credit cards offer solid rewards. I have been taking full advantage of a variety of credit cards the past few years. The points and miles I’ve gained have helped make our trips – including international trips to places like St. Martin and Aruba – more affordable.

The reward credit card I recommend others open first is the Chase Sapphire Preferred, which offers you 60,000 bonus points when you spend $4,000 within the first three months of card opening. You can compare this with other credit cards here.

Cash Back Websites

For those who don’t use cash back websites, I’m begging you: start using them!

Most stores, brands, and websites offer some form of cash back on purchases. At the same time, most people don’t take advantage of it.

I’ve gotten in the habit of always checking for cash back opportunities before checking out. For example, I’ll fill my cart at a store like Home Depot or Target and then go to google and search “Home Depot Cash Back” or “Target Cash Back.” I end up finding a portal (usually one I’ve already signed up for) and click through to get back to the website where my cart is already full. Then I check out.

This process ensures that I don’t spend more simply because there is a cash back opportunity. My car was already full and I was ready to check out anyway. I explain this process in more detail in this post.

Here are a few of the popular cash back portals that I end up using on a regular basis:

Health Savings Account – Optum Bank

Optum Bank is my Health Savings Account (or HSA) servicer, and I use their website regularly for a couple of reasons: 1) to reimburse myself for prescriptions and 2) to shift dollars into the investment portion of my HSA.

The reason I go into their site to reimburse myself for expenses is simple: I want the credit card rewards! When you have an HSA you typically have a debit card that is linked to it. I never use mine, though, because you can also put any eligible medical costs on a credit card and reimburse yourself through your HSA. It’s a simple process as the reimbursement gets direct deposited to my bank account.

One thing people don’t typically realize is that you can put your HSA funds into investment accounts like mutual funds. Once your HSA account exceeds a certain value, say $2,000, you can shift anything additional to the investment portion of the account. Each month I check to see if my account has exceeded the minimum required cash amount and shift anything extra to the investment portion.

Want to learn more? Read why I think an HSA is the best retirement account.

______________________________________________________________________________________

There are many more financial tools and apps out there that are useful and can help you manage your money better. This list is simply the ones that I use on a monthly basis and have found particularly useful.

What tools or apps do you use on a monthly basis?