This post is part of the #DRAFTISCOMING campaign with support from DRAFT, in partnership with Kasai Media.

This post is part of the #DRAFTISCOMING campaign with support from DRAFT, in partnership with Kasai Media.

Draft app’s core mission is to use crowdsource data to help you understand your portfolio and compare it, in aspects like performance and expenses, with others.

Too many millennials have been scared off of investing due to coming of age in the financial crisis and witnessing historic losses. Since we tend to not trust the market as much as other generations, we are more likely to stagnantly sit on our cash instead of investing.

Even if you trust the market, you may be scared off by the sometimes intimidating market industry jargon, or you may believe that high fees will make investing with lower sums not worth the hassle.

Consider plugging your financial information into a retirement calculator to see at which age you would be able to retire with your current financial situation. Seeing an age like 90 may be the shock you need to get started with your investments. Don’t let fear of the market, or a belief that you don’t have enough money to get started, stop you from investing.

There’s no question that an unwillingness to get involved in the market will hurt you financially in the long run. Stop sitting on cash which isn’t gaining any interest or dividends. To make the most of your money, you need to take the plunge into the world of investing and diversify your investments based on your specific situation.

Identify your investing goals

Once you decide to get started, you need to ask yourself what kind of investor you would like to be. Do you want to invest to build wealth, support a family, or prepare for retirement? Do you want a combination of the three?

Are you comfortable with high risk stocks or would you rather maintain a more conservative portfolio? What is your time frame for earning money? Do you need money more immediately, or do you have several decades in which to build your wealth? These are just a few of the questions you need to ask to appropriately diversify your portfolio for your unique situation.

A diversified portfolio looks different for each individual

Since everyone has different investing goals, timelines, and monetary needs, a diversified portfolio will look very different for each person’s specific situation. To build a diversified portfolio, you need to make sure that your investments are supporting your financial goals. Diversify your portfolio through a combination of bonds, temporary investments, and stocks which align with your own individual goals and risk level.

If for example, your main focus as an investor is to build wealth to support your family, you may want to aim to build a more flexible portfolio. Easy access to your accounts to pay for school tuition, camp fees, or orthodontia etc. can help you make ends meet when supporting your family.

If you are younger and childless, then you have the time to focus a percentage of your investments in long-term, higher risk stocks. Those same investments won’t make sense once you’re in your 60s or 70s though. At that point, you would want to re-balance your portfolio to have more short-term wealth building investments.

No matter your age or financial goals, due to political change, economic downturn, and changing interest rates, you should strive to achieve a diversified portfolio of stocks, bonds, and other investments to protect yourself from the fluctuations in the market.

Understand your risk comfort level

Understanding which risk level you are most comfortable with is the most important step to diversifying your portfolio according to your financial goals. Do you want high risk, high yield investments, or do you want low risk, lower yield investments? Just remember that the bigger the risk, the greater the return or loss.

Quickly building your portfolio through high risk/high reward stocks is possible, but you have to be willing to take that high risk. High risk stocks are usually the most profitable, but the risk is higher because of the ups and downs in the market. In order to take advantage of their higher return yields, you need to have a longer time frame to diminish the gamble of loss.

Monitor your portfolio and know when to diversify

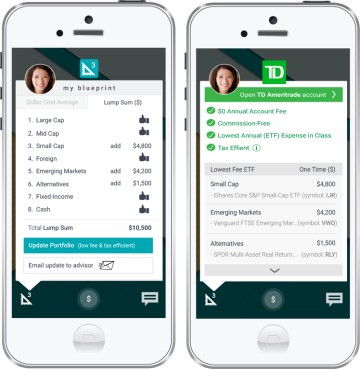

After deciding which combination of investments works the best for your situation, you can use the Draft app percentage tool to identify any under-performing assets and see how your portfolio compares to your peers.

Draft will also help you to understand your investment type (conservative, moderate, or aggressive), historical returns, asset allocation, and annual investment fees.

Draft will keep you aware of when your portfolio isn’t performing sufficiently for your financial needs, and when you may need to re-balance or diversify your investments. If your portfolio shows high risk when you would rather be at a conservative level, for example, you will know to contact your financial adviser.

High fees and under-performing funds will cause your assets to generate far lower returns than the market in general. Draft is designed to show you the degree of under-performance within your assets, so that you can re-allocate your investments accordingly. Draft makes it easier for you to understand when to re-balance your funds across different categories in the market. Once you identify any under-performing assets, you can re-invest accordingly.

Have confidence to engage with your investments

Don’t be afraid to discuss your portfolio with your financial adviser, and don’t let a fear of the markets or the financial jargon and fees sway you from building the portfolio that is right for you. Build your wealth incrementally over time, saving as much as you can, as early as you can, and set reasonable goals.

Draft makes what can be a scary and confusing topic much less intimidating. The performance, fees, and diversification of your portfolio will be at your fingertips, helping you to understand and make better investment decisions for your current situation.

It is Draft’s mission to “give people the information and insight to craft their own investment strategy, without having to become trained investment advisers themselves.”

If you want to be part of the early Fall public beta release of Draft, sign up for the wait list now so that you will be one of the first to try the application.

I love that there are so many tools to take the fear and confusion out of investing. Hopefully Draft will be another way to encourage more people to start investing.

I am pretty excited about the release of Draft. It looks like it will be a great tool!

Interesting app, I like the diversification analysis.

I think understanding your risk tolerance is key. It’s so important for people to understand that their portfolio of investments should directly reflect the amount of risk they’re willing to take on.

mrandmrsbudgets From what is available to see so far, it definitely looks like a well laid out and helpful app for analyzing your investments.

Financial Tour Guide Agreed!