I mentioned last week that I became a contributor to the FeeX blog. Today I’d like to give an introduction to FeeX and how they can help you potentially save a ton of money for retirement (I’m talking tens of thousands of dollars, if not more).

I mentioned last week that I became a contributor to the FeeX blog. Today I’d like to give an introduction to FeeX and how they can help you potentially save a ton of money for retirement (I’m talking tens of thousands of dollars, if not more).

FeeX calls themselves the Robin Hood of Fees, and for good reason; most people don’t realize how much they pay in fees for their retirement accounts, nor do they have a good way to quantify that amount. FeeX helps address that problem.

In their own words:

FeeX is a reaction to hidden and excessive fees that can drain a third or more of Americans’ retirement savings. A Robin Hood for the digital age, FeeX is a community of people on a mission to rescue their life savings from the tyranny of unfair fees. The more people that sign up, the better FeeX can help everyone. Join the movement today!

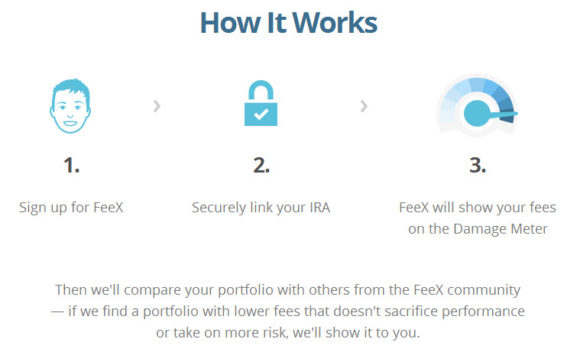

So how does FeeX come into play? If you have an IRA you can run an analysis on how much you are paying in fees and what the impact is to your personal finances, retirement in particular.

Once you sign up – which I should say is quick and easy, as you just need to enter your email and create a password – you then link your IRA so that FeeX can run an analysis. Worried about security? Read about their security and privacy policy here.

The folks over at FeeX spent a lot of time preparing this service for launch, so there’s already a ton of financial institutions that can be easily linked. Just a sampling of some popular ones:

I’ll let you head over and check out the features for yourself. You may be shocked to see just how much fees can affect your retirement long-term.

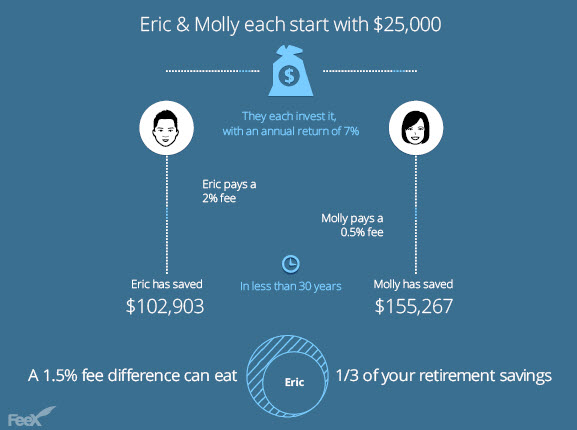

Let’s take a hypothetical example where two individuals invest $25,000 and let it grow for thirty years at an annual return of 7%. If the first individual has a 2% fee while the second has a .5% fee, the person with the higher fee loses 1/3 compared to the person with the lower fee. That’s a huge difference! In a visual format:

I learned some surprising things about retirement accounts when I was looking into IRAs. For example:

- 40% of American Households own an IRA

- IRAs as a whole make up $5.4 trillion in investments

- $43 billion in hidden expense ratio fees annually

- 40% of American Households own an IRA

- Expense ratios are 22% higher in IRAs than in 401(k)s

Source: 2013 Investment company factbook (ICI)

These are some pretty impressive numbers and definitely make me happy to have a 401(k) instead of an IRA. With that being said, one of my goals in 2014 is to open an IRA. Before learning these statistics and having an understanding of how fees have an impact on my retirement savings, I wouldn’t have worried quite as much about the fees I’m paying.

Have you ever considered how fees affect your retirement accounts? When was the last time you checked how much you spend in fees?

Wow this is a really cool application. I am definitely going to check this out! I haven’t really looked at the fees for my retirement but I guess that is something I really need to be monitoring more carefully.

BudgetforMore It’s pretty cool! It only has IRAs right now, not 401ks, but if you have an IRA you should try running it through the program and seeing what the analysis is. Let me know if you give it a try!

Looks like a cool program. I could write a whole post on this, and likely will :), but fees are riddled throughout the investment industry. The sad thing is that many don’t even stop to think about it, which will only be to their detriment in the long run.

got it. Well we have IRA’s so that will still be useful,

That’s pretty awesome. A lot of people don’t realize the amount of damage fees can do. That’s why I’m a fan of low cost index funds. Fees matter!

Good stuff, David! And congrats on the new gig.

Do you know if this service analyzes both 401k and IRA accounts. I’m fairly certain my Vanguard IRAs are fee free (except those built into the expense ratios of the funds themselves). But I’ve heard horror stories of hidden and hard-to-find fees in 401ks. Would love to get outside analysis of my work’s retirement plan.

FrugalRules You should write a post on fees! You probably have a lot more knowledge/insight than most. I’d be interested in hearing your perspective.

BudgetforMore Good to hear!

Andrew LivingRichCheaply I definitely don’t typically think about fees and how they impact my investments. Definitely something to keep in mind.

DonebyForty Right now they only have IRA analysis, though I believe they will be adding 401ks in the future (don’t quote me on that!).

Congrats on the gig DC and it sounds like an awesome company!! Retirement fund fees are typically not fees that people contemplate, but they definitely add up. I think a number of people don’t think about the fact that they may not have to leave their 401k in their company 401k; however, they can roll some to an individual IRA where they can manage it for much less fees. This sounds like a great resource for comparing options.

blonde_finance Thanks Shannon! It’s been great writing for them and I had fun taking a look at their tool for this post. I think fees aren’t talked about much, even in the pf ‘community.’ It’d be great to see more posts and analysis on this topic.

For a second I thought you’d joined FedEx! Way to go on landing that work. Did you find them or did they seek you out?

It’s always nice see efforts being made to educate people about investment fees and how costly they can be. I hope FeeX is successful and effective. I’m already very cognizant about what fees/expense ratios I’m paying, but I’ll probably still stop by FeeX to check them out.

PFUtopia Haha I can see how you’d accidentally read it as FedEx! I like the tool because it’s really easy to link your account and you get a report on the fees you pay, versus trying to piece it together in the fine print.

What are your thoughts on performance vs fees i.e. if a higher fee investment option performs better would you still go with a lower fee option?

mycareercrusade Depends. You’d have to calculate return after fees. If the return after fee is better on the higher fee fund, I’d go with that one.