I recently suggested that investors keep it simple.

I recently suggested that investors keep it simple.

There are way too many companies trying to sell complicated investment products or actively managed mutual funds with high expense ratios (or said differently, fees that go to those managing the fund).

Instead of loading up on complicated and expensive investment options, many investors would be better off keeping it simple by investing in index funds and ETFs that expose them to the broader market and have very low (0.25% or less) expense ratios.

We’ll start by discussing some of the criteria you should keep in mind when you are picking mutual funds within a retirement account or Health Savings Account (HSA), where your options will be limited based on the servicer of the account. Then we’ll talk about more general investing outside of retirement accounts and HSAs, where you have nearly unlimited options of what you can invest in.

Picking Funds within your Retirement and Health Savings Account

When a fund is actively-managed it comes with higher fees, which are reflected in a high expense ratio. Passively-managed funds, on the other hand, come with lower fees because the fund manager is trying to closely mimic an index (i.e. the S&P 500).

There are countless reports that actively-managed funds consistently underperform the benchmarks they are attempting to outperform. Do some outperform the benchmark? Yes. But a majority do not, and even more important is the fact that a fund could outperform a benchmark or index for a period of time and then go on to underperform the benchmark.

Not only does an actively-managed fund need to outperform the benchmark, though, but it also needs to outperform it by more than the expense ratio. For example if a benchmark return was 6.0% and an actively-managed fund charges a 1.5% expense ratio, then it must return 7.5% simply to provide an investor the same return as the benchmark.

With all this in mind there is one metric my eyes immediately go to when looking at the options within a 401(k), HSA, or other account that has limited investment options: expense ratio.

Let’s look at the options available in my Health Savings Account. (In case you weren’t aware, once you hit a minimum balance in an HSA, such as $2,000, you can shift anything above that balance to an investment fund. More on HSAs and my quest to build a $100k HSA.)

When I go in my HSA dashboard (I have Optum Bank as my HSA servicer), I go to the Investments drop-down and click on “Fund Information” to see what options are available to me.

Here’s some of the options I have:

As you can see they don’t have expense ratio information pulled in. In fact, they recommend people click on each one individually to view all the details in Morningstar. While it’s generally a good idea to look at the fund information in Morningstar, at this point we just want to see expense ratio.

I dropped all this data into Google Sheets and used this formula to pull expense ratio (with D7 correlating to the ticker column): =GOOGLEFINANCE(D7,”expenseratio”)

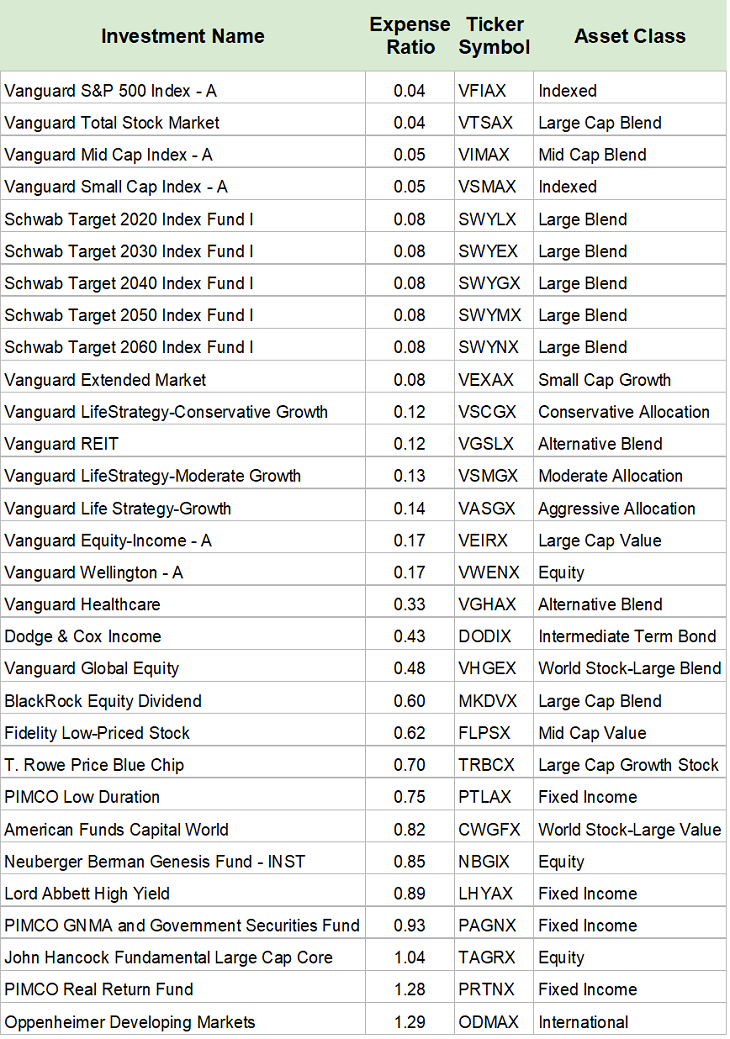

Once I pull in the Expense Ratio and filter on lowest to highest, here’s the result:

The first four options, with expense ratios of 0.05% or less, are particularly attractive. The first one aligns to the S&P 500 index, while the second attempts to give exposure to the broader stock market (including value, small-cap, and mid-cap companies).

I should pause here and say I cannot recommend specific mutual funds, ETFs, or investments for your specific situation. I am not a Certified Financial Planner and even if I was I would not have the background on your situation to recommend specific allocations. Everything I am sharing is general information.

With that in mind, I personally look for these broad-market index funds when I am choosing mutual funds and ETFs to invest in. VTSAX, the second option in the list above, is widely believed to be one of the best if not the best broad-based investment option.

An important thing to point out: not every account will have these favorable options.

When my wife started at a new employer and I reviewed the fund options in her 403(b), it was disheartening to see a majority of the options had a 1.00% or higher expense ratio. There were maybe one or two “somewhat” low expense-ratio options.

You very well could be in the same boat where you only have one or two options available after you filter out all the high expense ratio actively-managed funds. It may be worth pointing out to HR the desire for fund options with lower expense ratios. After all, if they don’t hear feedback they will assume everyone is happy with their options.

Good Index Funds and ETFs to Consider Investing In

As you can see in my Optum Bank HSA, the options can sometimes be a bit overwhelming. If I hadn’t filtered the options by expense ratio it would have been easy to become overwhelmed by the sheer number of options. This is the problem we run into when we are investing outside of retirement and other tax-deferred accounts.

Ultimately it’s a good problem to have because we can look for the best of the best funds or ETFs.

In case you aren’t familiar, Exchange Traded Funds, or ETFs, are very similar to mutual funds. The main difference is that ETFs are traded similar to stocks, with price updates in real-time. Mutual funds, on the other hand, are only priced once a day. ETFs typically are more tax efficient as well, though Vanguard mutual funds are very tax efficient and even patented the approach they use to avoid taxes.

Another difference is that mutual funds will typically have a minimum required investment amount. For example, Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX) requires $3,000 minimum investment. An alternative to get around the minimum would be to invest in the Vanguard Total Stock Market ETF (VTI), which has a similar investment goal as VTSAX (and a low expense ratio of 0.03%).

Below are a handful of good index funds and ETFs to consider investing in. “Good” is a relative term when it comes to investing, but in this case we are looking for low expense ratios and broad exposure to the market.

- Fidelity ZERO Total Market Index Fund (FZROX)

Objective (from the Fidelity website): The fund seeks to provide investment results that correspond to the total return of a broad range of U.S. stocks.ETF or Mutual Fund: Mutual Fund

Expense Ratio (Fees): 0.00%

Minimum Investment: $0

- Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX)

Objective (from the Vanguard website): Designed to provide investors with exposure to the entire U.S. equity market, including small-, mid-, and large-cap growth and value stocks..ETF or Mutual Fund: Mutual Fund

Expense Ratio (Fees): 0.04%

Minimum Investment: $3,000

- Vanguard Total Stock Market ETF (VTI)

Objective (from the Vanguard website): Vanguard Total Stock Market ETF is an exchange-traded share class of Vanguard Total Stock Market Index Fund, which employs an indexing investment approach designed to track the performance of the CRSP US Total Market Index, which represents approximately 100% of the investable U.S. stock market and includes large-, mid-, small-, and micro-cap stocks regularly traded on the New York Stock Exchange and Nasdaq.ETF or Mutual Fund: Mutual Fund

Expense Ratio (Fees): 0.03%

Minimum Investment: Cost of 1 Share is approximately $150

- Fidelity Total International Index Fund (FTIHX)

Objective (from the Fidelity website): Seeks to provide investment results that correspond to the total return of foreign developed and emerging stock markets.ETF or Mutual Fund: Mutual Fund

Expense Ratio (Fees): 0.06%

Minimum Investment: $0

These are just a handful of options, and there are certainly other good low expense ratio options out there if you are looking for broad market exposure. Before investing be sure to do your research so you are comfortable with the fund or ETF’s investment strategy.