A 401k is a great way to start working towards retirement. If you’re lucky, your company may even match your contributions up to a certain percent.

A 401k is a great way to start working towards retirement. If you’re lucky, your company may even match your contributions up to a certain percent.

Taking advantage of a 401k is usually a good idea. Even if you have a lot of debt, a 401k match is something that you shouldn’t pass up.

One thing is true regardless of whether you just started to invest in a 401k or have a sizable nest egg built up: you want to have your 401k exposed to the best investments.

The mutual fund options available to you will largely depend on who is servicing your employer’s 401k. You likely will have anywhere from 10-30 mutual funds to chose from, and the variety of options can be overwhelming.

My wife started a new job within the past year at a nonprofit, which offers a 403b (virtually the same as a 401k). When I was looking at the mutual fund options, it was clear that a large majority of the options were bad. Why? Because most were actively managed funds that had expense ratios of more than 1.0%.

I’m not a Certified Financial Planner and this should not be construed as investment advice, but one of the first things I recommend people do when they are investing, within a retirement account or otherwise, is to keep it simple.

Two things to avoid (in general) are actively managed funds and high expense ratios, which typically go hand-in-hand. There are many reports that indicate actively managed funds do not, over time, outperform the benchmark they are comparing against. Some do, but a majority do not.

With that in mind, an investor is better off picking funds that are passively managed with low expense ratios compared to actively managed funds. If you buy a mutual fund outside of a retirement account there are many great options available to you, including some with expense ratios of 0.00% (yes, zero!). But if we are talking about a retirement account like a 401k, you will be limited to what the servicer offers.

When it comes to analyzing 401k options, the first thing I recommend people do is drop all the mutual funds into a spreadsheet and filter based on expense ratio, lowest to highest. Ideally there is at least one fund available to you that gives you broad exposure to the United States stock market that has a low expense ratio.

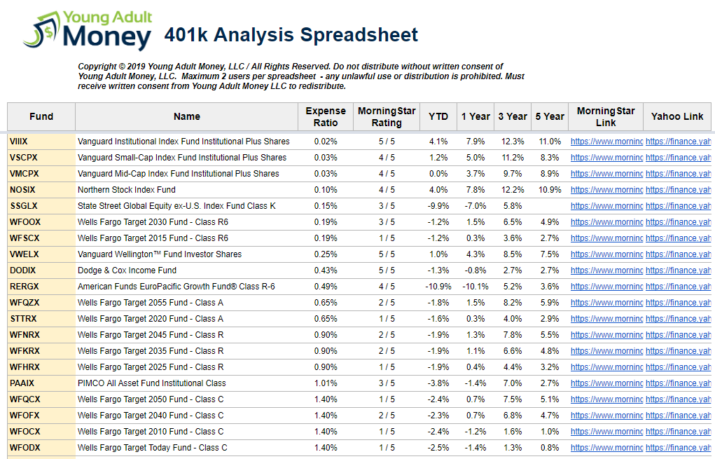

Let’s look at a hypothetical 401k. Using the 401k spreadsheet, I’ve dropped in the fund symbols in the left-hand column and the Name and Expense Ratio automatically populate (the actual spreadsheet has more data in columns to the right, but let’s focus on expense ratio for now).

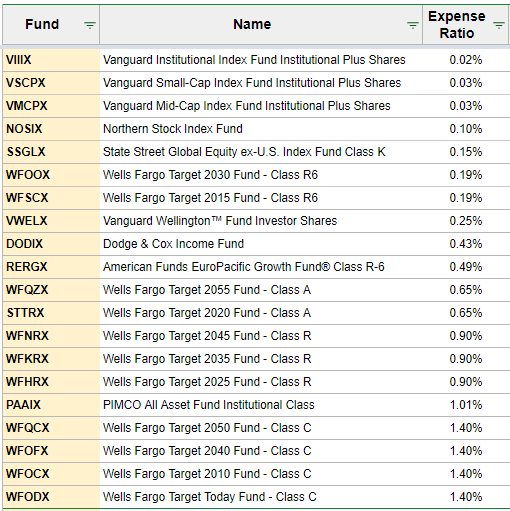

Now let’s sort by expense ratio:

My eyes immediately go to the top three options because it’s clear by looking at the expense ratio that these are passively managed. Pulling in a full view of the 401k spreadsheet (click the image below for a larger view), you can see that these three funds have very high ratings from Morningstar, which is a financial services company that analyzes funds. The Morningstar Rating is a measure of a fund’s risk-adjusted return, relative to similar funds. Again, all the information in the 401k spreadsheet is automatically pulled in once you drop in the fund’s symbol.

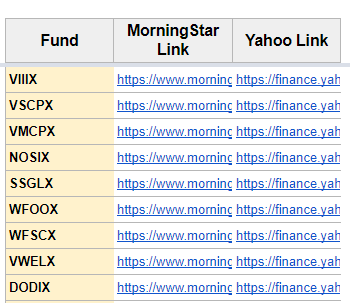

You may be interested in reading more about each fund. Within the spreadsheet there is a link to the Morningstar page for the fund as well as the Yahoo Finance page. All you have to do is hover over the cell and the URL will pop up. The Morningstar page for the fund has a ton of useful information and I encourage you to take a look for each of the funds you are considering investing in.

What About Target Date Funds?

Most retirement accounts offer a variety of target date funds. These funds essentially try to balance your risk exposure depending on when your target retirement date is. For example, someone who is planning on retiring in five years will generally want a more conservative portfolio than someone whose planned retirement date is still thirty years out. These target date funds do some of the work for you by adjusting how much of the portfolio is in stocks, bonds, cash, etc.

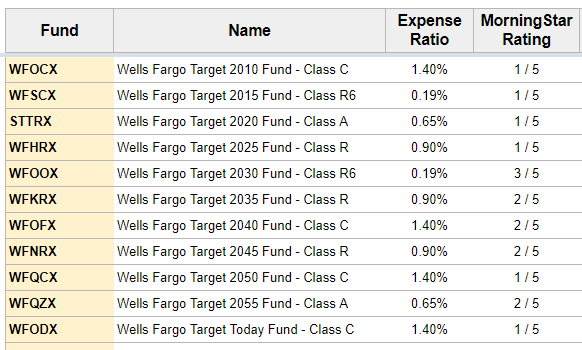

Target date funds have their place, but I hate the high expense ratio that they typically come with, as can be seen below. Morningstar is the go-to for fund research, so it says something when the rating is low, which is the case for these funds in particular.

While not everyone will agree with this, there is a growing sentiment that target date funds may not have it right after all. Let’s say you retire at 60 or 65. You could potentially live another 30+ years. You also may have very expensive health care in your later years. Why miss out on 10, 20, 30, or more years of exposure to the stock market? The historical sentiment that you should move almost all your assets into ultra-conservative holdings like cash and bonds may not make sense anymore.

What About Global Exposure?

There’s differing opinions on whether you need exposure to funds that specifically exposure emerging markets and/or the global economy. Some investors will argue that having broad exposure to the US market is enough. They definitely have a point that many US companies operate globally and, in turn, you have global exposure by default. But others will want some portion of their portfolio exposed to funds that are specifically targeting emerging markets, Europe, or the global economy as a whole.

Through my 401k and Health Savings Account (yes, you can invest a portion of your HSA similar to other tax-differed accounts), I have some of my portfolio in funds that are focused on investments outside the United States. I personally think having a small portion of your portfolio in these funds is useful, but it’s a personal choice and I understand the argument against it.

The 401k Spreadsheet

Ready to analyze your 401k? You can get a copy of my 401k spreadsheet sent to your inbox by entering your email below. You will be added to our email list, but you can unsubscribe at any time.

Didn’t see the email? Check your spam folder.

Join our Online Community to Receive your FREE 401k Analysis Spreadsheet

Good luck filtering through all your 401k options so you are invested in only the best mutual funds. There are many in the financial services industry who over-complicate things because it’s how more money can be made, but keeping it simple is usually the best approach.

Don’t hesitate to reach out with questions!