For many years I used a 1% cash back credit card for all my purchases.

While this wasn’t a bad move – 1% is better than nothing, which is what you get from a debit card – it’s not ideal.

There are credit cards that offer 2% cash back on every purchase, which is double what I was getting. There are also many cards that have lucrative sign-up offers that I was completely missing out on.

If you start utilizing credit card rewards to make your vacations free or cheap, or to collect free cash back rewards, you are likely going to have a number of cards open. Some of these cards inevitably will come with an annual fee, or with a sign-up bonus that you must achieve within a certain amount of time (e.g. spend $2,000 within the first 4 months of card opening to earn 50,000 points that can be redeemed for a $500 statement credit, for example).

Between cash back credit cards, airline credit cards, and “point” credit cards, my wife and I have multiple credit cards.

It can be difficult to keep everything straight when you have multiple cards open, so I asked myself recently: why don’t I just take a few minutes when I open a card to record information in a spreadsheet?.

I create spreadsheets all the time. I work in spreadsheets all day at work and spreadsheet consulting is one of my side hustles. Many times it’s a no-brainer to me that setting up a spreadsheet is a good idea.

So I created a credit card rewards tracking spreadsheet in Excel.

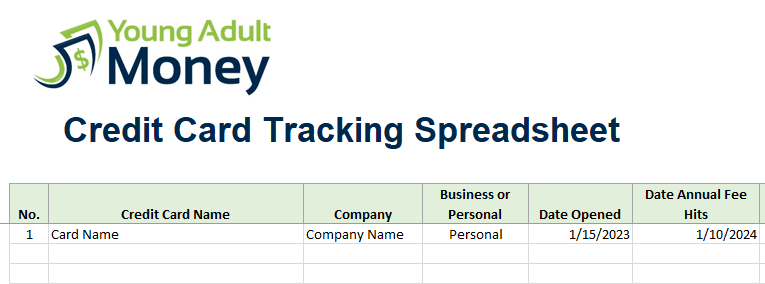

The Credit Card Rewards Tracking Spreadsheet in Excel

The spreadsheet I created is simple yet effective. It can help you avoid forgetting about a card and having it renew, and it will help you keep a history of the rewards that you’ve gained so far.

This spreadsheet has a variety of columns to capture everything you would want to know about the card you signed up for, including when you would want to cancel it by to avoid the annual fee. The columns include:

- Number

- Credit Card Name

- Company

- Business or Personal

- Date Opened

- Date Annual Fee Hits

- Closed?

- Annual Fee

- Annual Fee Waived First Year?

- Bonus: Spend Required

- Bonus: Spend Timeline

- Bonus Complete By Date

- Bonus Description

- Bonus Program

- Who Signed Up?

- Notes

When you download the file you’ll see an example credit card I added in the first row. This example can serve as a guide to populate your credit cards. You can also add or delete columns as you see fit.

I’ve been using this spreadsheet for over five years and it’s one that I keep going back to. I have yet to see a better system for managing all your credit cards and tracking rewards and annual fees.

If you want the free credit card rewards tracking spreadsheet fill in the form below and it will be sent to your email.

Join our Online Community to Receive your FREE Credit Card Rewards Tracking File

I want to start using credit cards for travel rewards. My daughter wants to go to Disney (I don’t know if I should cry or be happy that I’ll get another chance to go). I already use one to order our household supplies from Amazon every month and I’ve become disciplined to pay it off in full each month. I’m considering one that will help offset those Disney costs:/

I’m sure this worksheet will come in handy when I’m ready to take on the challenge! Thanks for sharing it with us!

Haha yes Disney can cause conflicting feelings once you are an adult ;) I think your daughter would remember the trip forever, though, so I’m sure it’s worth going!

I do something similar to keep track of our cards as well. We’ve got too many cards not to have something to help me keep track of what we’re doing. We haven’t opened a card in the past year or so since we knew we’d be buying a house, but now that our buying process is over we’ll be opening a few new ones very soon.

I had the biggest fear of credit cards for the longest time, but I finally got my first travel rewards card, and I will likely get another rewards card in the future. I actually can’t believe how much I have already earned in rewards just by doing my normal spending. Thanks for the spreadsheet!

I can totally relate to you being surprised how much you can earn with your regular spending. We’ve been tracking our spending for four years now so we have a good idea of what our regular costs are and even plan our bigger purchases around cards.

Your welcome for the spreadsheet! Feel free to share with others : )

We use credit card reward for travel. Chase Sapphire was the last card we opened. The key is paying the bill in full monthly and only use it for everyday purchases. Thanks for the spreadsheet!

Nice, Chase Sapphire is definitely my top pick right now. No problem on the spreadsheet, hope you and others find it useful!

Wow you are very organized…I need to be more like you! I’m a big fan of credit card rewards. I don’t churn them like some people do so my lack of organization hasn’t hurt me so far. I have a friend who has a spreadsheet or some document that he gives his wife so that she knows what credit card to use depending on where she’s shopping so she will optimize cash back rewards!

Oh! You just gave me an idea for version 2 of the file ;) Haha

We’ve been churning credit cards for a few years now, but it was only 6 months ago I started using a spreadsheet and it has changed everything! Luckily I didn’t make any big mistakes handling all the cards (have about 15 open at any time between me and my wife). But with the spreadsheet it makes it so much easier. No more fishing through old emails or statements to see when the annual fee will come due.

Definitely and that’s why I created this spreadsheet for my wife and I. Makes it so much easier, even if you only have a few cards open.

looking forward to travel savings