The following is a paid review from TransUnion, but opinions are my own.

The following is a paid review from TransUnion, but opinions are my own.

Just last week we found out about a massive data breach at the second biggest health insurance company in the United States.

Personal data – including social security numbers – of approximately 80 million employees and customers were stolen by a group of hackers.

These data breaches are becoming all too common, and there is no sign of it stopping anytime soon. After all, the data is valuable and can be used to steal identities and wreck havoc on people’s credit.

Thankfully there has been new tools and practices put in place that helps protect your credit. One of the new tools was created by TransUnion, one of the three major credit bureaus in the United States. The tool is called Credit Lock.

I was lucky enough to have the opportunity to test out the Credit Lock tool. This has potential to literally “lock out” identity thieves and makes it difficult for them to open up new lines of credit in your name.

How Credit Lock Works

To understand the value that Credit Lock provides, you have to understand what the traditional process was for locking your credit. If you wanted to lock your credit, you would have to make phone calls, wait on the credit bureau, and possibly submit a written petition. In other words: it wasn’t easy.

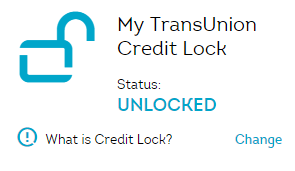

With Credit Lock on TransUnion’s app you can lock or unlock your credit at any time with a swipe of your finger. You can also log into the TransUnion website to lock or unlock your credit. The best feature of Credit Lock? It’s available 24/7.

Here’s what the Credit Lock feature looks like on TransUnion’s website:

No phone calls, no waiting. It’s as easy as that.

As I mentioned, TransUnion is one of the three major credit bureaus in the United States. They recommend keeping your credit locked until you need to open a new line of credit, and for good reason: leaving your credit open when you aren’t planning on opening a new line of credit doesn’t benefit you. Keeping your credit locked prevents identity thieves from opening new lines of credit in your name.

When your credit is locked TransUnion will alert you whenever an inquiry is made on your credit. If you forgot to unlock your credit, no worries. But if it was someone trying to fraudulently open credit in your name they will be stopped in their tracks.

Additional Features

Credit Lock is part of the larger TransUnion credit monitoring application. Additional features include:

- Credit Report Summary – See a summary version of your credit report. This will include details of all your lines of credit such as credit cards, auto loans, etc.

- Credit Restoration – If you’re identity has been stolen you can access a live identity theft restoration assistant that will help you restore your identity.

- Credit Score – View your VantageScore® Credit Score and Grade by TransUnion. Find out what’s impacting your score, where you rank compared to other consumers, and more.

Experts for decades have been recommending keeping tabs on your credit due to the potential of inaccuracies or fraudulent activities. In recent times, though, it’s become more important than ever to have some sort of credit monitoring in place.

Credit Lock has created a new tool that truly helps protect your credit. What better way to protect yourself from identity thieves than to put a lock on your credit until you need it opened?

What do you think about Credit Lock? Do you like the idea of being able to lock your credit when you aren’t applying for new lines of credit?

____________

First Photo by kev-shine

The older I get I realize how important it is to safeguard my info online. It is such a fear of mine now. I haven’t decided to sign up with a company to safeguard my identity, but I do realize how important it is now.

Nice review DC. I’ve never really given much thought to locking our credit because of the associated hassle that comes with getting it unlocked. We get our credit reports 3 times per year and stay on top of things pretty closely so I’m fairly comfortable as it is.

Sounds like an interesting new tool, DC. Sadly these days we have to extra watchful of our credit with all the data breaches that seem to be occurring all too frequently. Out of curiosity, if say an prospective employer runs a credit check on someone who has locked their credit through this program, what happens? Does the employer just receive notification that they report has been blocked or do the person have a chance to unblock it first?

I love this. Anything that make life easier, particularly in the financial realm, is golden. :)

kay ~ lifestylevoices.com I have to agree with you Kay. It’s awesome to see how technology is making the world more efficient.

Debtfreemartini There’s a lot of companies out there that are offering to protect people these days. The interesting thing is I didn’t realize that you could “lock” your credit until I looked into this service. With that being said, it seemed like generally it did not make sense to lock your credit because of how difficult it was to lock/unlock your credit.

FrugalRules Thanks John. I think you’re right that for most people locking/unlocking was not a viable or realistic option because of the hassle that comes with getting it unlocked. It makes you wonder…is seeing your credit report once a year enough? I feel a post coming out of that question….

ShannonRyan Interesting question, Shannon, I did not think of that. I imagine the user would get a notification just like if anyone else tried to check their credit when it was locked? Thankfully this tool makes it easy to unlock your credit; in the past it wasn’t practical due to the very scenario you pointed out.

It seems like a great tool, but what about Experion and Equifax?

No Nonsense Landlord Yes, it would be great if Experion and Equifax developed a similar tool. It also would be great if a third party made it possible to lock all three at once. For now, though, the process is still separate for each credit agency.

This is new to me. As I start to clean up my “act” my mom asked me just yesterday what I was doing to protect my hard work. I monitor using a 3 bureau service. That isn’t enough? Ugh, I do wish this lock was for all 3 as it is a terrific idea! But paying down debt versus paying to protect identity is a hard choice.

DebtFreeToBe Yeah it would be great if this was for all 3 credit bureaus, but as far as I know TransUnion is the only one who has implemented this technology. Paying down debt is definitely a balancing game where you need to pick and choose what you prioritize.