This post is brought to you by Debitize, but all opinions are my own.

This post is brought to you by Debitize, but all opinions are my own.

Many people do not use credit cards because they do not trust themselves with them. Perhaps they had a negative experience in the past or they have simply have never had a credit card.

If you fall in this group you aren’t alone. There are even personal finance bloggers who refuse to use credit cards.

While not using credit cards is certainly better than getting into credit card debt, there are some big benefits that come with having credit cards.

As Catherine explained in a recent post, having a credit card is essential to building your credit score. The older your credit cards, the better your score. By not having a credit card you are giving the credit bureaus less history – and that’s not a good thing.

Another perk of credit cards is the rewards that come with them. Forget travel hacking – even the most basic credit card should provide you with some sort of reward. For me my go-to credit card is my Discover card which gives me 1% cash back on every purchase and quarterly rotating 5% cash back bonus categories. Simply using my credit card instead of cash has allowed me to rack up a sizable amount of rewards over time.

I’ve had a credit card since my senior year of high school and having such a long credit history has helped me build up a great credit score. This has allowed me to save a ton of money through credit card rewards and signing up for multiple cards. But I realize this is not the case for everyone.

If you would like to have a credit card but are concerned about potentially over-spending, I have good news for you: there is a new service that provides you the benefits of having a credit card (or credit cards) but also builds in spending safeguards that will help you not overspend.

The Benefits of Credit with the Peace of Mind of Debit

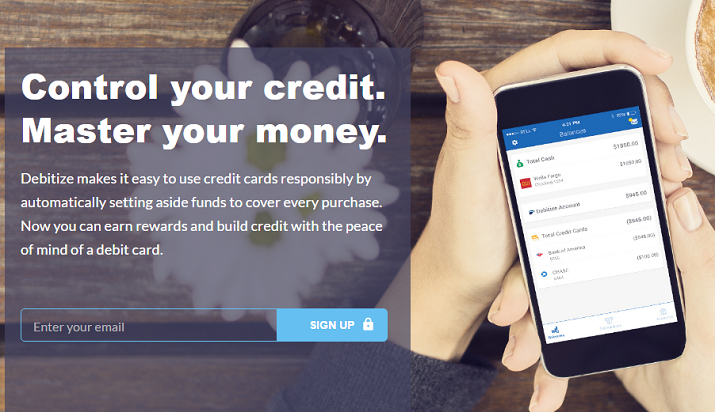

Debitize is a free service (you can sign up here for your free account) that helps consumers take advantage of the benefits of credit cards while also having the security of debit cards. Credit card debt is a huge issue today with nearly $750 billion of credit card debt outstanding as of the end of 2015. Credit cards present a very real risk of debt to many consumers.

Debitize can be broken down into 4 steps:

- Sign up and link a checking and credit card account

- Use your credit card as you normally would

- Funds will automatically transfer from your checking account to your Debitize account each time you make a purchase on your credit card

- Each month your credit card bill will be paid with funds from your Debitize account

By linking to a checking account, Debitize is able to take funds from your checking account and use them to pay your credit card bills. Funds are moved over with each purchase, so Debitize tracks your balance in real-time. Your credit card bill is paid one week prior to the due date using the funds that have already been moved over from your checking account.

You might be wondering: does Debitize prevent me from making credit card transactions if I don’t have enough in my checking account? The short answer is no. If you are using Debitize it is still possible to charge more to your credit card than is in your checking account.

With that being said, Debitize is transferring funds every time you make a purchase. If your checking account goes near your pre-set minimum checking account balance (default is $100 but you can choose whatever limit you want), you will be warned by Debitize.

This “spending safeguard,” as I like to call it, is something that is missing from the traditional credit card service. Unless you are going into your account and paying it down after every purchase, you are only aware of your spending when you pay your bill each month. With Debitize your funds are literally moving out of your checking account each time you make a purchase. Meaning, you can log into your checking account throughout the month and know where you stand.

Another question that frequently comes up is how Debitize deals with overdrafts. As I mentioned, Debitize will not overdraft because it will not go below your pre-set minimum checking account balance. So if you always want, say, at least $2,000 in your checking account, Debitize will allow you to carry a balance on your credit card instead of withdrawing funds from your checking that would put you below your pre-set minimum. They will also send you a friendly reminder that your checking account is near it’s pre-set minimum :)

Who Should Use Debitize?

Debitize is useful for many people, not just those who are scared of credit cards. It’s useful for those who:

- Want a more accurate picture of their spending throughout the month

- Have had bad experiences with credit cards in the past

- Are trying to build their credit history

- Prefer the security of debit cards but want the perks that come with credit cards

- Want to use credit cards but are scared of credit card debt

Debitize is attractive for so many reasons, but ultimately the biggest perks are building up your credit history and taking advantage of credit card cash-back and sign-up bonuses.

Head on over to Debitize to set up your account today. It’s 100% free to use.

Do you or someone you know refuse to use credit cards? Does Debitize sound like a service that you would consider using?

Debitize is a very interesting idea that I have been debating trying out. We don’t have an issue using credit cards since we watch our spending fairly closely but I like the idea to bring our spending closer to our cashflow instead of having it lag 30 days behind. Nice review DC!

Thanks Thias! I love how you explained the value of Debitize even if you are good with credit cards. It’s a pretty awesome service they have!

I agree w/ the comment on cashflow. Never heard of this service but it could be a solid way to get the CC rewards while at the same time feeling the immediate effect of each purchase you make.

That’s definitely one thing I don’t like about credit cards. I dislike the big once-a-month payments versus debit cards where you are constantly seeing your balance adjusted.

This is really cool. Why don’t credit card companies do this already? They would get more loyal customers. I suspect they might add something like this a few years from now.

Very interesting concept. I could see why credit card companies don’t do this…they probably want consumers to overspend! It definitely would be valuable to have this to remind people how much money they have.

I think you are right on, Andrew. Credit card companies make a sizable profit from interest on outstanding balances. It takes an outside company like Debitize to fulfill the need.

I think this is a great idea! The only thing that I worry about is the fact that my financial information is more and more available as I sign up for different services. In today’s day and age, there are so many companies that link to your bank account. I’d have to look into Debitize’s security practices further.

Definitely a valid concern, Aliyyah! They address security on their faq page: https://debitize.com/faq.php

This is interesting. I wonder if user reviews are positive. Like Aliyyah, I’d need to know more about security. I’d hope, at least, they use a 2-step verification process.

It definitely serves a purpose! Valid concern. As I said to Aliyyah, they address security on their faq page: https://debitize.com/faq.php

Hey DC, thanks for sharing this :) It’s a cool idea and I hope it works well for whoever uses it. We don’t have any credit cards so this doesn’t really apply to us.

Tristan

Hey Tristan! I would disagree and say that this would still apply to you. In fact, I think a lot of people who don’t have credit cards would reconsider because of this service.

I had no idea there was a service out there like this for folks. This is definitely something worth sharing with others who are afraid of using credit. I actually had to scroll back up my facebook feed to make sure I was reading correctly. I’m like, “spending safeguards!” Thanks for sharing it with us…I learn something new everyday:)

No problem, Latoya! The service makes a lot of sense. It could give some people the visibility and safeguards they need to use credit cards no different than they would with debit cards.

This sounds similar to our newest tactic to build major credit card rewards. We move money out of the primary checking account into the secondary one for each purchase. Then we make a weekly payment on the card. It’s kind of labor-intensive, so it’s nice that the automated system is there.

That sounds very similar! I’m sure you appreciate the visibility into how much you truly have in your bank account.

I probably wouldn’t spend as much as I keep money in my savings account before pulling the money to pay the monthly bill. I’m assuming it can also be linked to a savings account for oddballs like me ;-)

Hey, DC!!

I got Debitized! I haven’t used a CC in years, but have been reading about folks using them for the benefits. Hadn’t thought seriously about getting one, until I saw your article. Since it makes the credit card work like me debit card, I can get the benefits for a rewards card, but have the cash come out as it’s been in the past.

I recently received a rewards card and immediately set it with Debitize. We have to replace the transmission in my wife’s card, so on the Debitized card it goes, I get the cash back, and the money comes out of the account. AWESOME system.

Thanks for sharing, and believe me, I will too! Now, I need to convince my wife to drop her old card, get a rewards card and Debitize it too. :-)

Thanks for all the great stuff you share!!!

Wow what an awesome testimonial Keith! I’m so glad you found it useful!