I’ve been saying it for a long time: whenever you make a purchase online, you should be getting cash back rewards.

I’ve been saying it for a long time: whenever you make a purchase online, you should be getting cash back rewards.

This is also true for in-store purchases, though these purchases are typically limited to cash back from credit cards.

Today I want to go over a simple way to “double-dip” cash back rewards, including real examples of my recent purchases where I doubled-up on cash back rewards.

Step #1: Cash Back Credit Card

Cash back credit cards are the easiest way to get cash back on every purchase.

But first I will say that no amount of rewards is worth getting into credit card debt. The only way to win with cash back from credit cards is to pay off your balance in full each month. If you’ve struggled with credit cards in the past or are paying down a balance, skip to Step #2 below.

Businesses get charged approximately 3% each time you swipe a credit card. They’ve already factored this into their pricing. Those who use cash back credit cards are getting a portion of that 3% back. If you use a debit card or pay cash, you are recovering none of the 3% credit card transaction fee that businesses have factored into their pricing.

You won’t find cards that will pay 3% on every purchase, but you will find a number of cards in the 1-2% range. You can browse all cash back rewards credit cards here, and this list includes the Citi® Double Cash Card which gives you 1% when you make a purchase and 1% when you make a payment, which equals 2% cash back.

For some simplicity is key, but there are also many cash back cards that offer a sign-up bonus or revolving 5% cash back categories. For example the Chase Freedom Cash Back Card currently offers a $150 cash bonus after you spend $500 within the first three months of account opening, and has quarterly rotating 5% cash back categories (on up to $1,500 of spend for a maximum of $75 per quarter).

Step #2: Cash Back Website or App

Now we get to the double-dip. If you use a cash back credit card in combination with a cash back website or app, you can effectively get twice the cash back.

We’ll get into examples in a moment, but for those who are unfamiliar with cash back websites and apps, they are essentially “portals” that give you cash back if you click through their link before making a purchase. There are a number of these web sites and I’ve used most of them. Here are a few examples:

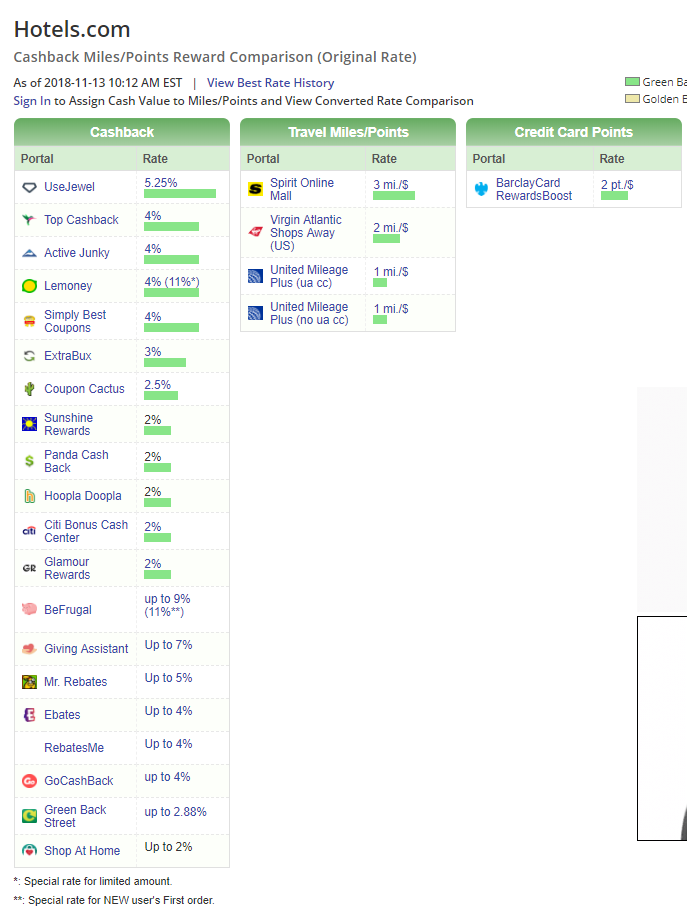

You may be wondering who has the time to check each cash back website to see which one has the highest cash back for a specific store or website? Thankfully someone else has taken care of that problem for us.

As I described in my post A Simple Hack I Use to Save Money When I Shop Online, if you simply Google “[Store/Website Name] Cash Back” the top results will be websites that check the sites for you and put them in a nice little list. Here’s a screenshot from Cashback Monitor, my go-to website:

What I would recommend you do is sign up for 5-10 cash back websites (here’s 10+ options). Shop as you regularly would. You can even put all the items in your cart before going to a cash back website or app. Then when you are ready to check out go to Google and look for the top cash back website. Go through that website’s portal and head back to the cart. Then, check out.

Once you’ve gotten used to this process it should take you less than 30 seconds to find the top cash back website and click through their portal.

Let’s go through some real examples of double-dipping on cash back rewards.

Example: Home Depot Purchase with 5% and 8% Cash Back

We recently bought a new washer and dryer, so I decided to build a wooden pedestal for them. Besides the supplies themselves, I also bought a circular saw and blade.

At minimum I would get 2% cash back from my go-to cash back credit card, but I always look and see if there is a better offer. At the time my credit card had a revolving 5% cash back rewards category for purchases made through PayPal.com. PayPal has come a long way the past couple of years, and the nice thing is that you don’t have to actually have cash in the account to make a purchase. You can make a purchase through a credit card.

So what ultimately happened was I got 8% cash back from the cash back app Lemoney (you can sign up here) and 5% cash back by making a purchase through PayPal (by linking my cash back credit card and using that in the PayPal checkout process).

The Result: for each $100 I spent I received $13, or 13%, cash back.

Not a bad deal, considering the fact only a small percentage of consumers take advantage of both of these opportunities. Most would get $1 to $2 cash back through their credit card.

Example: Hotels.com Purchase with 3% and 5% Cash Back

Hotels.com almost always has some sort of cash back available through a cash back app and website. Every once in a while you will see an amount at 5% plus. In fact, at the time of this writing there are cash back websites with 2% cash back on any booking and 8% if the booking doesn’t qualify for hotels.com reward nights.

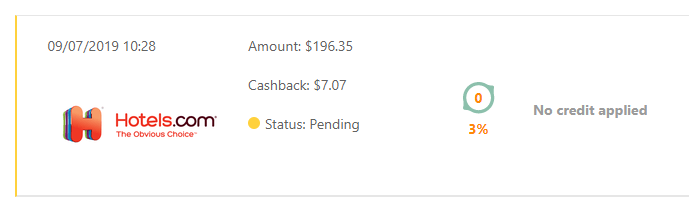

I’ve had a few weddings recently where I needed to book a hotel room. I received slightly more than 3% cash back from a cash back website (lemoney again), as can be seen below. Keep in mind that it can take a while for these purchases to be verified, sometimes 30-60 days after the purchase was made. With Hotels.com it could be even longer as they won’t award you cash back until a certain time frame after the date of the stay, not the date of the purchase (hence why the below was in pending status as of early October).

Similar to the Home Depot example above, I made the purchase using my credit card through PayPal, which awarded me 5% instead of the standard 2%.

The Result: Received $7.07 + $9.82 for a total of $16.89 cash back (nearly 9%) on a $196.35 purchase.

Added Bonus: Hotels.com has a rewards program where you get a free hotel stay after you purchase ten nights. Rewards programs like this allow you to get additional perks even after you double-dip on cash back.

Example: Best Buy Purchase: 2% Cash Back + 5,000 United Airlines Miles

For this final example I wanted to share a slightly different approach I took. As I mentioned earlier, my wife and I recently bought a new washer and dryer. We went for the fancy LG models. After factoring in the cost of the actual units, installation, and haul-away service, we spent nearly $2,300.

With this purchase we received a standard 2% cash back from a cash back rewards credit card. But instead of going through a cash back portal, which would have only given us 1% cash back, we went through the United MileagePlus Shopping portal where we received 2 miles per $1, which was a short-term promotion they were offering (typically they only offer 1 mile per $ for Best Buy purchases).

We were able to net nearly 5,000 miles. If used correctly, these will go a lot further than the $23 (1% cash back) we would have received by going through a cash back portal. Plus, with both my wife and I having a United Explorer Card, we are always looking to add miles when it makes sense.

The Result: Received $46 cash back and 4,600 United Miles for a total of $16.89 cash back (nearly 9%) on a $196.35 purchase.

Added Bonus: Similar to Hotels.com, Best Buy has a rewards program. After this purchase I received a $20 Best Buy reward certificate.

To recap, you can double-dip cash back rewards by taking advantage of both cash back credit cards and cash back websites and apps. This will typically result in a minimum of 3% combined cash back, but at times can surpass 10%+ cash back.

I love the concept and use it all the time! I like to do the triple dip. Use a cash back app or website, use a coupon code (using a tool like honey app or retailmenot), and then buy and use a discounted gift card through a site like Raise or Gift Card Granny (using a cash back credit card of course). Wait, is that a quadruple dip?

Ah yes those discounted cards add another layer to it! The one drawback to that is it takes a *little* more effort than the cash back credit cards + cash back rewards portal. Thanks to the sites that aggregate which portal gives the best cash back at any one time, I truly believe it can take less than a minute, sometimes less than 30 seconds, to quickly click through the portals and get back to your shopping cart. And credit card rewards are simply how you pay. With all that being said, you are right that the gift cards can add another layer to it and provide additional cash back.