The best way to limit the amount of money you spend is by sticking to a budget.

The best way to limit the amount of money you spend is by sticking to a budget.

You don’t have to love budgeting. Most people don’t. But it can be extremely effective.

Today we are combining two of my favorite topics: spreadsheets and money.

The advantages of using a spreadsheet instead of a budgeting app is that a spreadsheet can be customized. An app, not so much.

Let’s walk through how to make a budget in a spreadsheet, step by step.

Open a Blank Spreadsheet in Microsoft Excel

Easy enough, right? If you don’t have much background in spreadsheets, don’t be intimidated by them. There’s a lot that can be done with spreadsheets and a ton of advanced features, but you don’t need them to make a simple budget in a spreadsheet.

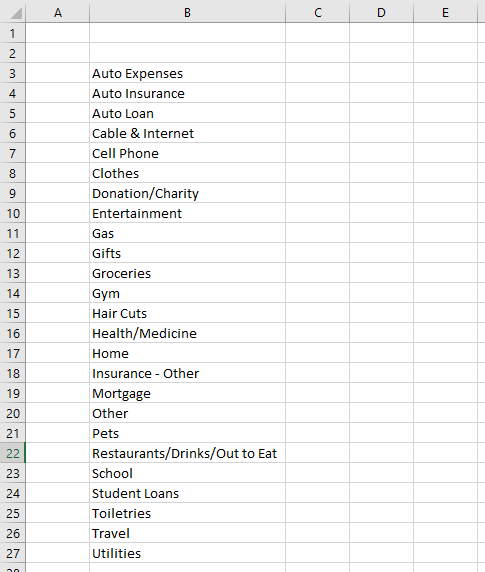

Add Budget Categories

Next we’ll add some budget categories. You can add ones that you think are most relevant to you, but “groceries” and “rent” are common ones.

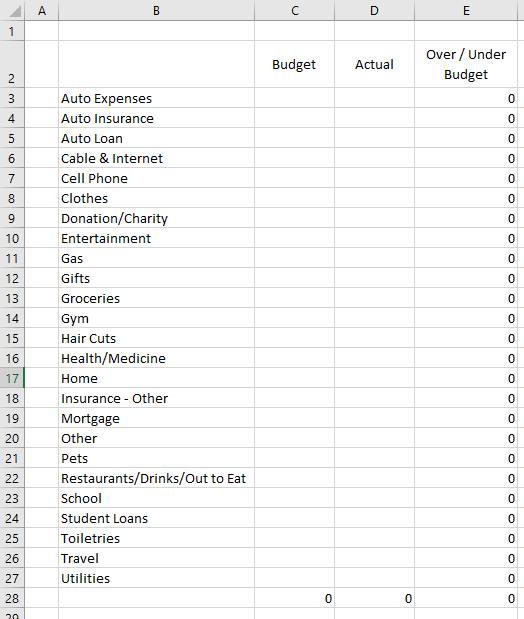

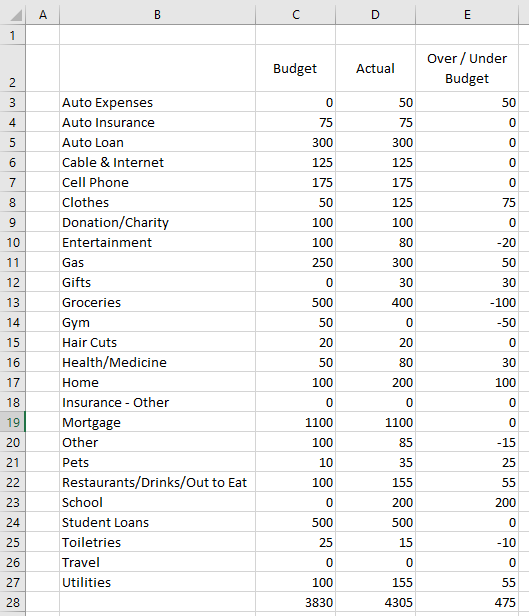

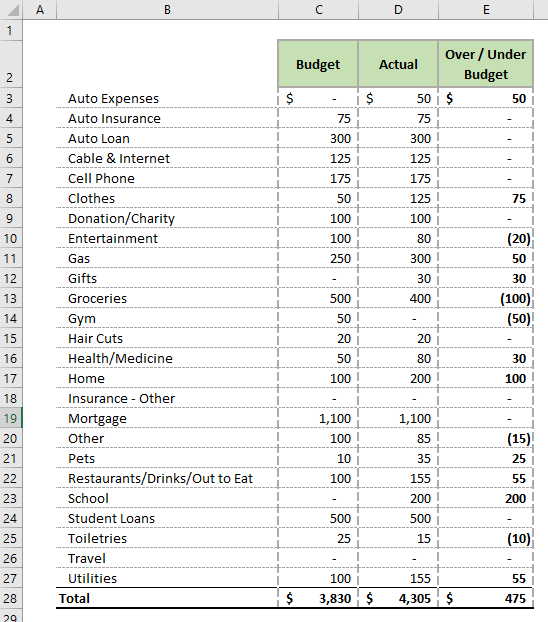

Create Two Columns for Dollars: Budget and Actual

Now we’ll add two columns: Budget and Actual. We’ll also add a third column that compares the two. The formula for that comparison column is the cell in column D less the cell in column C. At the bottom you should also add a formula to sum up the total. In this case my formula in cell C28 is =SUM(C3:C27).

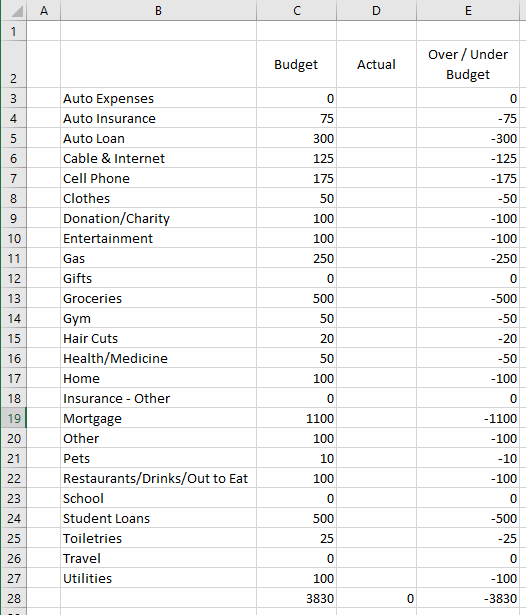

Add Amounts to your Budget Column

Now we will populate our budget column with our monthly budget.

You may be wondering how do you know how much to budget for each category?

I’ve tried to simplify this budget in a spreadsheet as much as possible, but it’s true we’ve missed a key first step. If you don’t know how much money you spend, and on what, it’s tough to set a budget. Do you spend $200 a month on groceries of $500? That will have a big impact on whether a $300 grocery budget will be easy or tough.

You have two options at this point. One option is you wing it and set a budget for each category of what feels about right. The other is to look at your past three months of income and expenses. That means going through all your credit card and bank statements, compiling the data into a simple format, and seeing what the average spend is by category.

Option two is preferable, but can be time consuming. I used to do this manually at the end of each month until I started to use Tiller, which grabs all this data automatically and dumps it in a spreadsheet. It does this in a uniform format so you don’t have to mess around with reformatting.

Regardless of how you do it, at the end of this step in the process you should have your budget set.

Update your Actual Column Throughout the Month

Throughout the month you should update your budget spreadsheet with how much you actually spend on each category. You can do this daily, weekly, or even wait until the end of the month. If you are trying to stick to a really strict budget it makes sense to go with the daily or weekly update to ensure you are on track.

You can check all your accounts and manually drop in your spend details by category, or you can leverage Tiller. Since I do a lot of travel hacking with credit cards I am oftentimes using a few different credit cards, so Tiller makes it a lot easier to review my spending.

Below is an example of what our budget in a spreadsheet may look like after the month is over. In this case we spent $100 less on groceries than we budgeted, and we didn’t sign up for a gym so we were $50 under-budget there. Unfortunately, though, we were $475 over budget in total because we overspent on school (textbooks), clothes, home-related purchases, utilities, auto expenses, and some other categories.

If you want you can also reformat the cells to make it easier to look at.

A Better Way: An Automated Budget in a Spreadsheet

While there is nothing wrong with creating a simple budget in a spreadsheet, I created a free one you can download. It does leverage Tiller which makes it a truly “automated” budget spreadsheet.

You can find out more about the free automated budget spreadsheet here or you can download by filling out the box below. This will add you to our email list, but you can unsubscribe at any time.

Join our Online Community to Receive your FREE Automated Budget Spreadsheet in Excel