I was watching a morning show recently where the topic of discussion was millennials and their lack of retirement savings.

I was watching a morning show recently where the topic of discussion was millennials and their lack of retirement savings.

While most of the panel seemed to have neutral views on millennials themselves, one member of the panel tore into millennials. They cited millennials lack of work ethic and their need for instant gratification.

This panel member’s opinions stayed on my mind throughout the day. I felt the criticism was unfair because it essentially meant that other generations had better work ethic and didn’t desire gratification as quickly as millennials, among other criticisms.

If we look at generational differences from a macro-level view, though, we see a different story. Millennials are in fact financially subsidizing older generations all while dealing with unprecedented student loan debt and higher cost of living than previous generations at similar points in their lives.

There’s three specific areas where this financial subsidization is undeniable. Let’s go through each.

National Debt

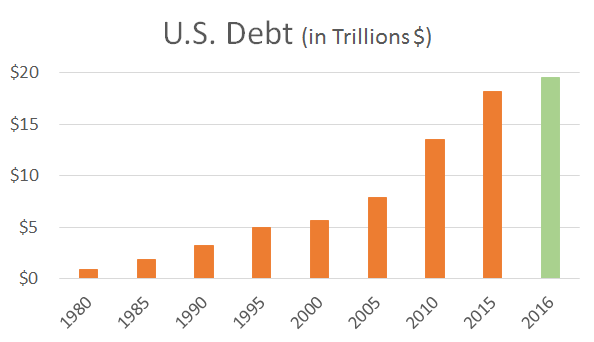

The national debt is nearly $20 trillion. Like all debt, our national debt will need to be paid back at some point, and clearly older generations have decided to push that responsibility down the road. Interest on our debt makes up a relatively large portion of the federal budget.

For one generation to simultaneously say that millennials desire instant gratification while at the same time running up a $20 trillion bill is simply unfair. Taking on this unprecedented level of debt is short-sighted and, in my opinion, irresponsible.

It’s easy to pass a budget when it’s hinged on debt financing. It’s difficult to pass a balanced budget or to pay down debt instead of taking on more.

Debt can be a tool and there is certainly ways to leverage debt for long-term gains from a personal finance perspective, but at the end of the day debt is debt. At a national level debt enables the government to continue to spend at unprecedented levels instead of restraining them and forcing them to make the tough choices of where tax dollars are best allocated.

I do realize that there are many millennials who are calling for even further debt spending, but until millennials make up the majority of government leadership (and continue the current debt trend) you can hardly blame them for our current debt situation. The debt that’s been incurred so far is certainly not due to millennials.

Healthcare

Healthcare is expensive. The fact that multiple companies took on millions of dollars of losses in the health care exchanges shows that even relatively expensive high deductible plans couldn’t overcome the sheer cost of care. And we should expect healthcare to continue to be expensive as people live longer and we see groundbreaking advancements in medicine over the next few decades.

With all that being said, the challenge we are facing now is how to find a balance of making insurance available and affordable for all. Unfortunately for millennials, who are already financially burdened in ways that previous generations were not, policy makers have decided they will be the ones that foot the bill.

The Affordable Care Act put pricing mechanisms in place where premiums can only differ based on age by a factor of three (i.e. can only be three times higher for older people than younger ones). That means lower premiums for older generations and higher premiums for younger generations compared to what they would be without this pricing floor and ceiling in place. The most recent Republican plan would have actually benefited millennials in this specific area as premium pricing would be able to flex based on age by a factor of five instead of three.

Besides being hit with higher premiums, millennials are at the front-end of the movement towards consumers being more responsible for the cost of care. A few years ago high deductible health plans and Health Savings Accounts, or HSAs, weren’t common. For many today it’s the only option they have for health insurance. And you can be sure that decades down the road when HSAs have higher balances that those savings will be used as justification for even further financial burden placed on the consumer.

Social Security

It’s widely known that Social Security is eerily similar to a Ponzi scheme. The money you pay in is immediately paid out to beneficiaries, not invested or set aside for your retirement. The first person to receive Social Security paychecks made out like a bandit as they paid in for a very short period of time but received benefits throughout their retirement.

Virtually every millennial I talk to is not expecting Social Security to be funded or available when they reach retirement age, despite currently paying into it and likely paying into it for many years or decades to come.

Considering the fact that millennials have come to accept this and haven’t placed a high level of energy or effort on reforming Social Security flies in the face of criticisms that millennials are self-absorbed and only care about themselves.

On a more technical note, the current structure of Social Security is unsustainable because there is a projected tightening of the ratio of retirees to workers over the next few decades. By the time millennials reach retirement the benefits they receive will need to either be greatly diminished, funded by debt, or eliminated altogether.

___________________________________________________

My goal with this post is to simply highlight the financial burdens millennials – and soon generation Z as well – have taken on.

Anyone can attack millennials and make broad generalizations about them, but what they can’t do is deny that younger generations have taken on three huge financial burdens that older generations are either unable or unwilling to deal with themselves.

Another important thing to point out is that millennials for the most part have had little say in any of this. From Social Security to Healthcare, the decisions that negatively impact millennials’ finances were made largely without their opinion or consent.

The biggest question is whether millennials will continue the trend of taking advantage of younger generations financially. It’s easy for me to write my criticisms of older generations, but in twenty or thirty years will a 20-something blogger be writing this same post?

Insightful analysis, DC. I hadn’t thought about the future higher balances of HSAs being used to justify more weight of financial responsibility being placed on the patient/consumer.

I also get a bit bristly when people tear into millennials for not knowing how to work hard. But I think we have to admit–whether characterizations are accurate or not–that speaking about generational trends requires “over-generalizing” almost by definition. That said, there’s no reason to get nasty or too one-sided about it.

Agreed. For some reason there are people who love to talk down on the millennial generation and have a very negative view on them. I think the three things I mentioned are three huge problems that older generations simply have punted to millennials (and beyond), and we are talking billions and billions of dollars.

Great post. I’ve seen a lot of negative articles criticizing millennials and it’s often unwarranted. I think many of the older generations do not understand the struggles of the current generation. Student loan debt? “I worked my way through college to pay for it!” Sure…but tuition was a fraction of the cost! “I took an entry level job and worked my way up” Okay, the economy was booming back then and jobs were plentiful.

I work in government and have a pension as well as many benefits. I am lucky. But the older employees have even better benefits which they get to keep while they just slowly decrease the benefits for younger employees. The older employees fight tooth and nail to keep their gold plated benefits even when that fight probably has a negative result on the younger employees benefits.