It can be tough to find time to focus on personal finance while you are in college.

It can be tough to find time to focus on personal finance while you are in college.

After all, college students have very little “extra” time. They are trying to perform well in all their classes, and many have numerous obligations outside of class such as working, volunteering, organization involvement, and social lives.

And that’s not to say life gets less busy when you are out of college, but it’s better to confront your finances right away out of college than ignore them for a few years.

One example where taking control of your financial life right away can pay off is through Public Service Loan Forgiveness, or PSLF as it is commonly referred to as. This is the government program where certain federal student loans on certain repayment plans (income-driven repayment plans) are eligible for loan forgiveness after 120 qualified monthly payments. These payments must be made while working for a 501(c)(3) or government employer.

If you knew this right out of school it may impact where you decide to work. It also is a complex program that essentially forces you to understand the ins and outs of the program. But if you didn’t take the time to even become aware of PSLF you may make a costly mistake such as refinancing through a private lender, when in reality keeping your federal loans would have been a good move.

That is just one example of many where confronting your finances right after you graduate college can pay off dividends down the road.

The books in this list have the advice, information, and action items to get you started on the right foot. So if you are a 2019 college grad or know someone who is graduating, grab a copy of these books. They will more than pay off.

Here’s a quick summary of the books, followed by a more detailed description of each.

Summary:

Student Loans

- Student Loan Solution: 5 Steps to Take Control of your Student Loans and Financial Life by David Carlson

General Personal Finance

Career

- Corporate Survival Guide for Your Twenties by Kayla Cruz

- Ask a Manager: How to Navigate Clueless Colleagues, Lunch-Stealing Bosses, and the Rest of Your Life at Work by Alison Green

Student Loans

Student Loan Solution: 5 Steps to Take Control of your Student Loans and Financial Life

From Amazon: Lower Your Student Loan Debt

Personalize your approach to student loans: Those who have student loans, especially those with a lot of student loans, need to approach their finances differently than those who do not have student loan debt. Student Loan Solution explains what student loan borrowers should be focusing on when it comes to their finances above and beyond managing their student loan debt. Additionally, it shows borrowers how to take advantage of strategies that help them make more money, save more money, and ultimately pay down their student loans faster.

Be smarter than your student loan debt: Loans should be straightforward, but unfortunately, student loans are complicated. College financial aid terms like “federal direct subsidized” and “GRAD Plus” mean little to most of us, but each type of student loan is slightly different, with its own set of rules and repayment options. Student Loan Solution explains everything you need to know about your student loans. From how student loans work, to student loan repayment options and opportunities for loan forgiveness, to creating a plan for managing and paying down your loans, author David Carlson covers it all.

De-complicate your life: By the time you are done reading Student Loan Solution, you will understand your student loans, gain control of your finances, and be armed with strategies to improve your finances and, ultimately, your life.

Be more than a statistic: For millions of Americans, paying for college meant taking out loans. If you are one of the 70% of college graduates with student loans, Student Loan Solution has financial advice for you. Fight the student loans epidemic affecting 40 million borrowers―learn the best way to pay off the college degree you worked so hard to earn.

A step-by-step approach: Student Loan Solution uses a 5-step approach to help you understand your loans, your options, and how to improve your greater financial life while paying down your student loan debt. A topic that can be overwhelming is simplified through the step-by-step approach that gives clear action items that keep you moving forward in your journey to repay your loans.

Student Loan Solution has the tools you need to start your student loans repayment with a bang. In this book, David Carlson provides the tools and financial advice to:

- Pay off your student loan debt

- Personalize your student loan repayment plan

- Live a happier, more financially knowledgeable life

Title: Student Loan Solution: 5 Steps to Take Control of your Student Loans and Financial Life

Author: David Carlson

General Personal Finance

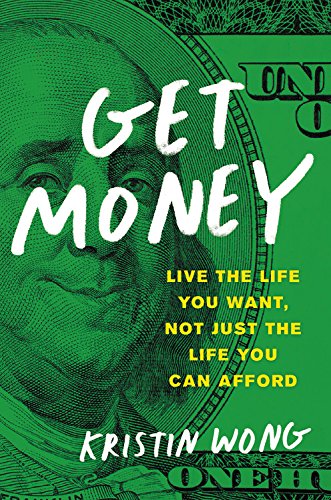

Get Money: Live the Life You Want, Not Just the Life You Can Afford

From Amazon: Learn how to live the life you want, not just the life you can afford!

Managing your money is like going to the dentist or standing in line at the DMV. Nobody wants to do it, but at some point, it’s inevitable: you need to clean your teeth, renew your license, and manage your personal finances like a grown-up. Whether you’re struggling to pay off student loan debt, ready to stop living paycheck to paycheck, or have finally accepted that your Beanie Baby collection will never pay off, tackling your finances may seem immensely intimidating. But it doesn’t have to be. In fact, by approaching it as a game–or something that requires you to set clear goals, as well as face challenges you must “beat”–personal finance can not only be easy to understand, but it can also be fun!

In Get Money, personal finance expert Kristin Wong shows you the exact steps to getting more money in your pocket without letting it rule your life. Through a series of challenges designed to boost your personal finance I.Q., interviews with other leading financial experts, and exercises tailored to help you achieve even your biggest goals, you’ll learn valuable skills such as:

- Building a budget that (gasp) actually works

- Super-charging a debt payoff plan

- How to strategically hack your credit score

- Negotiating like a shark (or at least a piranha)

- Side-hustling to speed up your money goals

- Starting a lazy investment portfolio…and many more!

Simply put, with this gamified guide to personal finance, you’ll no longer stress about understanding how your finances work–you’ll finally “get” money.

Title: Get Money: Live the Life You Want, Not Just the Life You Can Afford

Author: Kristin Wong

Broke Millennial: Stop Scraping By and Get Your Financial Life Together

From Amazon: Stop Living Paycheck to Paycheck and Get Your Financial Life Together (#GYFLT)!

If you’re a cash-strapped 20- or 30-something, it’s easy to get freaked out by finances. But you’re not doomed to spend your life drowning in debt or mystified by money. It’s time to stop scraping by and take control of your money and your life with this savvy and smart guide.

Broke Millennial shows step-by-step how to go from flat-broke to financial badass. Unlike most personal finance books out there, it doesn’t just cover boring stuff like credit card debt, investing, and dealing with the dreaded “B” word (budgeting). Financial expert Erin Lowry goes beyond the basics to tackle tricky money matters and situations most of us face #IRL.

Title: Broke Millennial: Stop Scraping By and Get Your Financial Life Together

Author: Erin Lowry

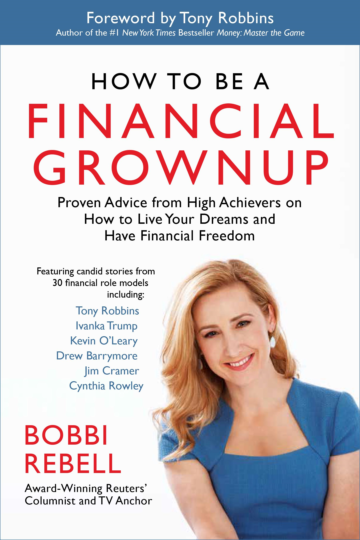

How to Be a Financial Grownup: Proven Advice from High Achievers on How to Live Your Dreams and Have Financial Freedom

From Amazon: Bobbi Rebell, award-winning TV anchor and personal finance columnist at Thomson Reuters, taps into her exclusive network of business leaders to share with you stories of the financial lessons they learned early in their lives that helped them become successful. She then uses these stories as jumping off points to offer specific, actionable advice on how you can become a financial grownup just like them.

Financial role models such as Author Tony Robbins, Entrepreneur Ivanka Trump, Shark Tank’s Kevin O’Leary, Mad Money’s Jim Cramer, Designer Cynthia Rowley, Macy’s CEO Terry Lundgren, Zillow’s CEO Spencer Rascoff, PwC’s CEO Bob Moritz, and twenty others share their stories with you.

Title: Broke Millennial: Stop Scraping By and Get Your Financial Life Together

Author: Bobbi Rebell

Career

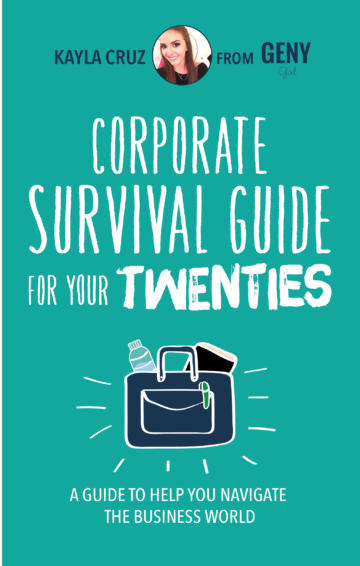

Corporate Survival Guide for Your Twenties: A Guide to Help You Navigate the Business World

From Amazon: Welcome to the corporate world, friend! A world where things aren’t fair, some people are mean, and if you want to succeed, your boss has to like you.

In her new book: Corporate Survival Guide for Your Twenties: A Guide to Help You Navigate the Business World, Kayla Buell, founder of the award-winning blog Lost GenY Girl, helps you face the corporate world post-college. Navigating a corporate working world filled with pitfalls and traps is not easy there’s no app for that.

Should you speak up in meetings? Should you stay quiet? Should you eat at your desk? What should you wear? And what do you do when someone blasts you via e-mail? In Corporate Survival Guide for Your Twenties, Buell helps the early career professionals get their kick-ass career running!

Title: Corporate Survival Guide for Your Twenties

Author: Kayla Cruz

Ask a Manager: How to Navigate Clueless Colleagues, Lunch-Stealing Bosses, and the Rest of Your Life at Work

From Amazon: From the creator of the popular website Ask a Manager and New York magazine’s work-advice columnist comes a witty, practical guide to navigating 200 difficult professional conversations—featuring all-new advice!

There’s a reason Alison Green has been called “the Dear Abby of the work world.” Ten years as a workplace-advice columnist have taught her that people avoid awkward conversations in the office because they simply don’t know what to say. Thankfully, Green does—and in this incredibly helpful book, she tackles the tough discussions you may need to have during your career. You’ll learn what to say when

- coworkers push their work on you—then take credit for it

- you accidentally trash-talk someone in an email then hit “reply all”

- you’re being micromanaged—or not being managed at all

- you catch a colleague in a lie

- your boss seems unhappy with your work

- your cubemate’s loud speakerphone is making you homicidal

- you got drunk at the holiday party

Title: Ask a Manager: How to Navigate Clueless Colleagues, Lunch-Stealing Bosses, and the Rest of Your Life at Work

Author: Alison Green

Summary:

Student Loans

- Student Loan Solution: 5 Steps to Take Control of your Student Loans and Financial Life by David Carlson

General Personal Finance

Career

- Corporate Survival Guide for Your Twenties by Kayla Cruz

- Ask a Manager: How to Navigate Clueless Colleagues, Lunch-Stealing Bosses, and the Rest of Your Life at Work by Alison Green

interesting also for adults that are into savvy mood:D