COVID has been mentally draining for many, myself included.

COVID has been mentally draining for many, myself included.

My goal today is to provide some clarity on what is happening to your student loans during COVID.

The $2 trillion coronavirus stimulus bill was passed by both the Senate and the House, and signed into law by President Trump.

The stimulus bill provided unprecedented relief to federal student loan borrowers.

Here are some key highlights of the 2020 coronavirus stimulus bill impact on student loan borrowers:

- All federal student loans will suspend payments for six months, ending September 30th, 2020

- This will happen automatically – borrowers do not have to do anything for payments to be suspended

- Any auto-debt payments that are/were processed between March 13, 2020 and September 30th, 2020, can be refunded to you. Contact your loan servicer if you have an auto-debit in that time range (many likely have them in March)

- Interest will not accrue during the six-month period that payments are suspended

- The six months of suspended payments will count towards Public Service Loan Forgiveness (PSLF)

- The six months of suspended payments will also count towards income-driven loan forgiveness

- Credit reports and scores will not be impacted by the suspension of student loan payments

- If a borrower is in default, the six months of suspended payments will count towards their nine months needed for loan rehabilitation

Nearly ten million student loan borrowers are in default. Let’s start by focusing on how they are impacted.

Help for Millions of Borrowers with Student Loans in Default

Prior to the stimulus bill there was already action taken by the Department of Education (DOE) to help those with student loans in default. The DOE announced on March 25th the halting of collections for at least 60 days, including the discontinuation of wage garnishment and seizure of tax refunds. This is backdated to March 13th, which will result in $1.8 Billion being refunded, impacting more than 830,000 borrowers.

From the DOE’s press release:

Additionally, private collection agencies have been instructed to halt all proactive collection activities, including making phone calls to borrowers and issuing collection letters and billing statements.

The Department must rely on employers to make the change to borrowers’ paychecks, so it will monitor employers’ compliance with the request to stop wage garnishment. Borrowers whose wages continue to be garnished after March 13 should contact their employers’ human resources department.

Borrowers with defaulted student loans, a current relationship with a private collection agency, and an interest in continuing a prior payment arrangement, consolidating their loans, or beginning a loan rehabilitation arrangement with their private collection agency, should contact the Department’s Default Resolution Group at 1-800-621-3115 (TTY for the deaf or hearing-impaired 1-877-825-9923). Private collection agencies are permitted to provide assistance upon the borrower’s request.

One strategy for those in default is to contact the collection agency or the Department’s Default Resolution Group (contact information above) and get started on the nine-month rehabilitation program. If they get started on this plan during the six months of payment suspensions (before September 30th, 2020), they will get credit for the months that payments have been suspended.

If your student loans are in default, I highly encourage you to take this time as an opportunity to get your loans out of default. Once you are out of default you can start working towards student loan forgiveness, either PSLF or income-driven loan forgiveness. The longer you put off getting out of default the longer you will have to wait for student loan forgiveness.

Private Student Loan Borrowers and Millions of People with FFEL Loans Get No Relief

The most disappointing aspect of the stimulus bill is that it gives zero relief to private student loan borrowers. If you refinanced $100,000 of federal student loans two months ago and lost your job due to coronavirus, you won’t find any relief in the $2 trillion stimulus bill. Because of how the stimulus checks will be calculated (based on 2019 or 2018 income tax returns) you may not even receive all or any of the $1,200 per person checks that will be sent out.

This is simply unacceptable.

If you are a private student loan borrower who has lost their income, the best thing you can do is reach out to your lender and see what they can do to help you out in this difficult time. Every company is under pressure to handle the coronavirus crisis response in a positive way. In the age of social media there is a huge risk in leaving employees or customers out in the cold.

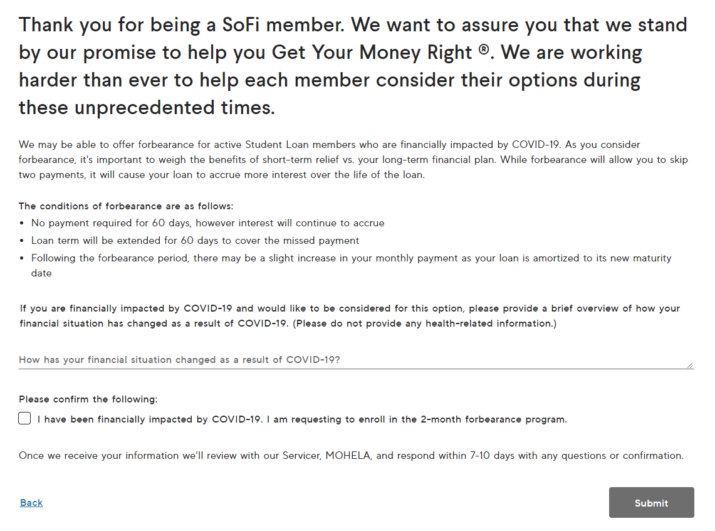

SoFi is offering 60 days of forbearance for student loan borrowers who have been financially impacted by COVID-19. The only information you need to provide is an explanation of how you were affected. You can see the form below (click for a larger view):

Another group that is not provided assistance is FFEL loans that are not owned by the federal government. That includes six million borrowers and over $100 Billion of loans.

To make these loans qualified you could consolidate them into a Direct Consolation loan. The only potential drawback of doing this is if you are working down the path of income-driven loan forgiveness. If you consolidate these loans you start back at square one from a student loan forgiveness perspective. For example if you have made payments on FFEL loans for ten years under an income-driven repayment plan, you may want to think twice about consolidating and starting back at zero.

Update 4/25: The Equity in Student Loan Relief Act has been introduced into the House by Representative Elise Stefanik (R-NY) that would give all FFEL student loan borrowers similar relief as those with Direct student loans received under the CARES Act. This is a developing story and we will keep you updated as it progresses.

Huge Win for Federal Student Loan Borrowers

The coronavirus stimulus bill is a huge win for those who have federal student loans. Federal student loan payments will automatically suspended for six months through September 30th, 2020. Interest from these payments not being made will not be accrued. This is truly a best case scenario for federal student loan borrowers and will immediately create cash flow that can be used to pay necessary expenses or create a cash buffer.

The fact this is automatic is important. The language in the bill makes it clear that this will happen and is not left to the executive branch to decide.

One thing borrowers should be excited about is the fact that all six months of suspended payments can be counted towards PSLF or income-driven loan forgiveness. My wife is working down the path of PSLF, as are more than a million borrowers, and it was important to us that we don’t miss out on six months of qualified payments.

Because this bill has not become law yet you will not see updates on the loan servicers websites. Once the bill becomes law you should see loan servicers updating both their websites and the borrowers whose loans they service.

In the meantime, continue to make your payments. I expect the changes to go into effect very quickly once the bill becomes law, but it’s not quite there yet.

This post will continue to be updated with new developments, so check back regularly. In the meantime please do not hesitate to reach out with questions. You can reach me directly DC (at) YoungAdultMoney.com.

Stay safe everyone.