Student loans can be complex. Annoyingly complex. Even painful. All the emotions.

There is no magical way to get rid of them quickly, especially if you have a lot of them.

The one thing you can do, though, is feel in control. To do that you need to get organized.

The best way to get organized is by putting all your data in a spreadsheet.

So naturally you may be wondering how to track your student loans in a spreadsheet?

You’re in luck – I have a free student loan spreadsheet that you can download.

This spreadsheet will help you get a good overall picture of your student loans, but it goes further than that. It will also run an analysis on your loans for income-driven repayment plans, provides a few repayment calculators, and more.

Grab the student loan spreadsheet by entering your email in the box below, or scroll on to read more about the spreadsheet.

Join our Online Community to Receive your FREE Student Loan Spreadsheet

The Features

The student loan spreadsheet has the following features:

- Instructions on Where to Find your Student Loans – Whether you have federal, private, or state student loans, there are instructions on how to find the details of your student loans.

- Tracking Tab to House all your Student Loan Details – The most important part of the spreadsheet. This will be where all your student loan detail is laid out in a nice snapshot.

- Student Loan Repayment Calculators – Three different student loan calculators that help you visualize what sort of impact putting additional dollars towards your loans will have.

- Weighted Average Interest Rate Calculation – Simplifies various calculations by giving you one interest rate that can be used in all your student loan repayment calculations.

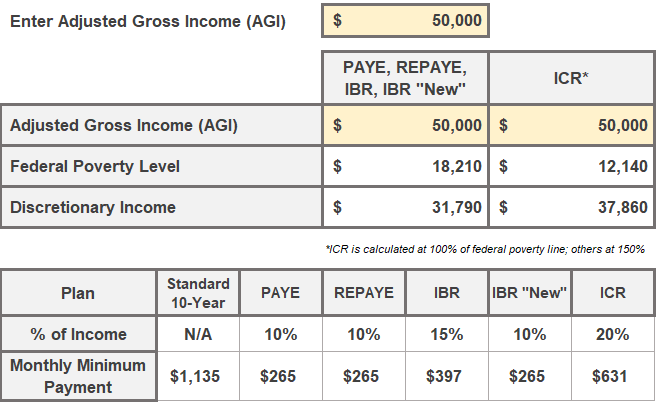

- Income-Driven Repayment Calculator – Shows your estimated monthly payment under the various income-driven repayment plans.

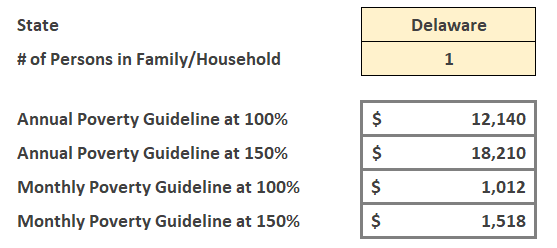

- Federal Poverty Guidelines – Helps with calculating income-driven repayment.

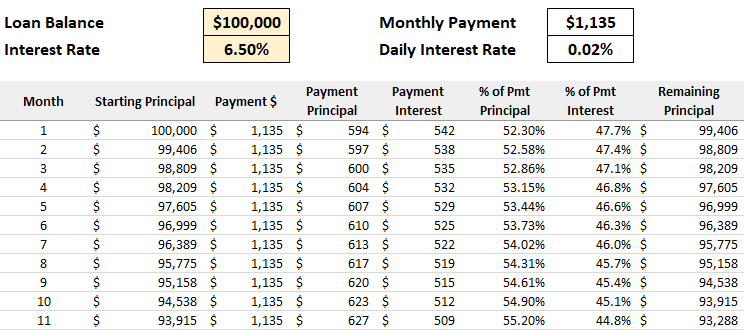

- Principal vs. Interest – Curious how much of each individual payment is going towards interest versus principal? This tool will help you visualize it.

Here’s more detail around the tabs you’ll find in the spreadsheet:

Table of Contents

This student loan spreadsheet has so many features that a table of contents felt necessary. This helps you easily jump to different sections of the spreadsheet.

Instructions on Where to Find your Student Loans

There are instructions within the spreadsheet on how to find all your student loans, regardless of whether they are federal, private, or through a State.

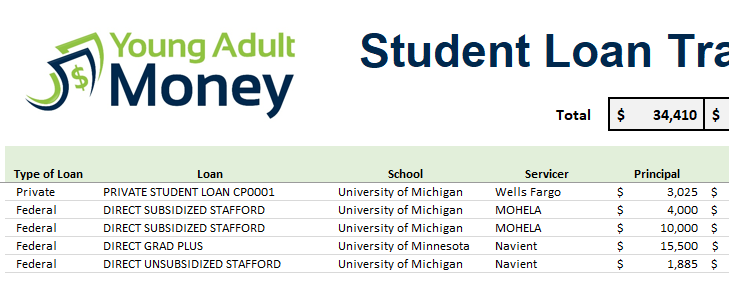

Tracking Tab to House all your Student Loan Details

This main tracking tab within the file is the most important and is the one that you will update over time with your student loan information. When you initially populate it you will identify whether your student loans are federal, private, or state, what the interest rate is on each loan, what the principal balance is, and more.

Student Loan Repayment Calculators

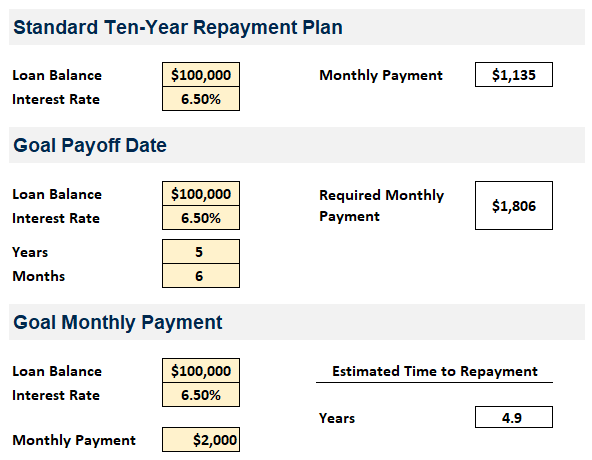

There are three student loan repayment calculators:

- Standard Ten-Year Repayment – Enter your loan balance and your interest rate and this calculator will tell you what your monthly payment is under the standard ten-year repayment plan.

- Goal Payoff Date – Do you have a goal date that you want to pay off your loans by? Curious how much you’d have to put towards your loans each month to make it happen? This calculator will tell you.

- Goal Monthly Payment – Curious how much faster your loans will be paid off if you put an extra hundred, two hundred, or more, towards your loans each month? This calculator is for you.

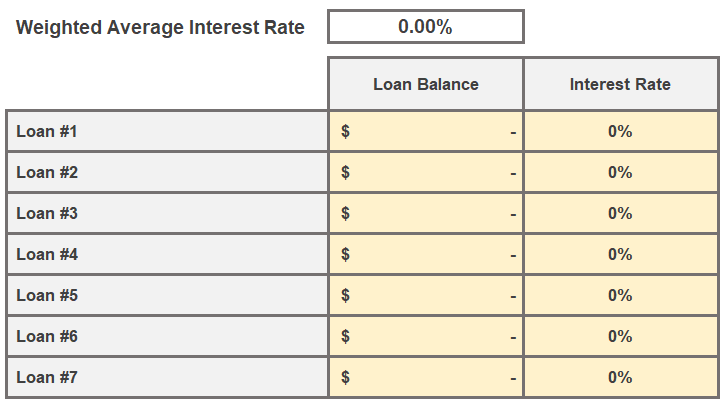

Weighted Average Interest Rate Calculation

Most people have a number of student loans, but for various estimates and calculations you want just one dollar amount (your total student loan debt) and one interest rate. This calculator will help you find what your weighted average interest rate is, which then can be used in calculators like the repayment ones I described above..

Income-Driven Repayment Calculator

Curious what your estimated payment would be if you switched from the standard ten-year repayment plan to an income-driven repayment plan? This calculator gives you an estimate of what your new monthly minimum payment will be under the various plans.

Federal Poverty Guidelines

Income-driven repayment plans can sometimes feel a bit complicated, as they factor in the federal poverty level, family size, and adjusted gross income. This tab will simplify that for you, allowing you to select from drop-downs to automatically run calculations that are used in the income-driven repayment estimates described above.

Principal vs. Interest

Have you been making payments towards your student loans for a while now but the balance doesn’t seem to drop much? If you’re on the standard ten-year repayment plan it’s because a greater percentage of your payment goes towards interest early on in repayment. This tab shows the detail behind the 120 payments and you can clearly see how the split between principal and interest changes over time.

nbsp;

Get the Free Student Loan Spreadsheet

Ready to download the free student loan spreadsheet and access all the features? Simply enter your email below and we will send you a copy.

Join our Online Community to Receive your FREE Student Loan Spreadsheet

Remember, the first step to conquering your student loans is understanding them. The sooner you understand your loans and repayment options, the sooner you can put together a repayment strategy that fits with your life. No two situations are the same, and I encourage you to do what makes the most sense for your specific situation.